Advertisement|Remove ads.

MSFT Stock Falls Over 7% In Pre-Market – Why Did Morgan Stanley Drop It From ‘Top Pick’ List?

- Morgan Stanley said Azure’s growth fell short of expectations for a larger upside.

- Goldman Sachs said that the stock slid on higher capex without faster Azure acceleration.

- Barclays said Microsoft’s story will “see a slight rethink,” as new AI capacity is being directed more toward first-party products like Copilot.

Shares of Microsoft Corp. (MSFT) fell 7.5% in pre-market trading on Thursday after a flurry of brokerage actions, including being removed as ‘Top Pick’ at Morgan Stanley after its second-quarter (Q2) 2026 results.

Despite posting better-than-expected second-quarter (Q2) revenue and earnings on Wednesday, its Azure unit growth slipped to 38% from 39% a year earlier. Microsoft also guided Azure revenue to rise between 37% and 38% in the third quarter.

What Are Analysts Saying?

Morgan Stanley analyst Keith Weiss dropped the stock from his top-pick list despite keeping an “Overweight” rating and a $650 price target, implying more than 45% upside from its current level near $446, according to The Fly. Weiss added that investor attention has narrowed to key GenAI indicators, particularly Azure and M365 Commercial Cloud performance, and Azure’s expansion beat guidance by just one point, falling short of expectations for a larger upside.

Citi cut the price target to $635 from $660 and reiterated a ‘Buy’ rating, calling the earnings report mixed, while Goldman Sachs slashed it to $600 from $655 and maintained a ‘Buy’ rating. Goldman Sachs added that the stock slid on higher capex without faster Azure acceleration. It sees increased AI and R&D investment supporting medium-term returns despite near-term pressure.

Barclays analyst Raimo Lenschow cut Microsoft’s price target to $600 from $610 while maintaining an ‘Overweight’ rating. Lenschow said Microsoft’s story will “see a slight rethink,” as new AI capacity is being directed more toward first-party products like Copilot, changing how upside is expected to materialize.

Brokerages, including Wells Fargo, Bernstein, and Piper Sandler, have also slashed their price target for Microsoft.

How Did Retail React?

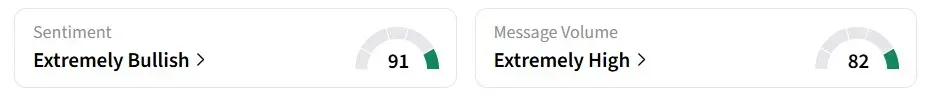

Despite MSFT stock price dropping, retail sentiment on Stocktwits flipped to ‘extremely bullish’ from ‘bullish’ a day earlier, amid ‘extremely high’ message volumes. MSFT was among the top trending tickers on the platform at the time of writing.

Chatter was mixed, with one user seeing good value.

While another user expected more growth.

While MSFT stock has gained more than 10% over the past year, it has seen a marginal decline so far in 2026.

Read also: Why Did SER Stock Surge Over 70% In Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_merck_logo_resized_05f46cfc54.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)