Advertisement|Remove ads.

MicroStrategy Lifts Retail Sentiment On $700M Offering To Retire Previous Debt And Buy More Bitcoin Even As Stock Dips

MicroStrategy (MSTR) drew strong retail interest on Tuesday after announcing a $700 million offering of convertible senior notes due in 2028.

The company, which made the announcement on Monday, plans to use the funds to pay off $500 million in Senior Secured Notes and buy more Bitcoin with the remainder.

As of midday, it was the second most trending ticker on Stocktwits, with investor sentiment remaining strongly bullish despite a dip in the stock price.

MicroStrategy’s latest quarterly report shows long-term net debt of over $3.7 billion.

However, CEO Michael Saylor’s belief in Bitcoin’s long-term value remains undeterred. Last week, MicroStrategy announced that it had bought over $1 billion worth of Bitcoin between August and mid-September.

Bitcoin, which has struggled for the past six months due to economic and geopolitical pressures, recently gained over 7% in a week on the back of favorable U.S. economic data and hopes for Federal Reserve rate cuts.

The cryptocurrency climbed past $61,000 to hit a three-week high on Tuesday.

Canaccord on Tuesday lowered its price target on MSTR to $173 from $185, maintaining a ‘Buy’ rating but fine-tuning its estimates after MicroStrategy’s recent 10:1 stock split.

Despite the tempered outlook, retail investors overwhelmingly supported the company’s strategy.

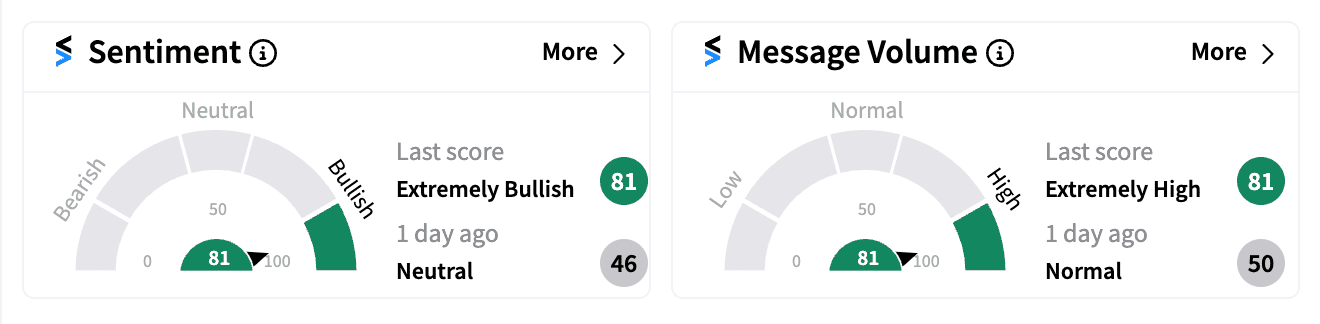

Sentiment on Stocktwits was ‘extremely bullish’ (81/100), with many applauding the firm’s move.

One user remarked, “$MSTR - The $700 mil offering is Bullish. Borrow worthless US Dollars to buy Bitcoin. Borrow rate = 5% You think Bitcoin will go up more than 5% per year? Of course. Saylor knows.”

Some voiced frustration with the market’s reaction to the offering but stood firm in their belief that the stock would recover, aligning with Saylor’s long-term vision.

Earlier this month, Saylor predicted Bitcoin could reach $13 million by 2045, suggesting that its current value represents only 0.1% of global capital and that it could grow to capture as much as 7%.

Interestingly, MicroStrategy’s stock is up more than 94% so far this year, significantly outperforming Bitcoin’s 37% gain.

Read next: Palantir, Gevo, GE Vernova Stocks Hit Fresh 52-Week Highs: Retail Bullish Only On Two

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Northrop_Grumman_resized_7270231cb2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_spglobal_OG_jpg_61bf3a69e9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_constellation_energy_three_mile_island_resized_3185b1517a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)