Advertisement|Remove ads.

MicroStrategy Stock Surges On $1B Bitcoin Buy Amid Crypto Dip: Retail Bulls Rejoice

Shares of MicroStrategy Inc. (MSTR) surged over 6% on Friday, hitting two-week highs, as the software firm announced its largest Bitcoin purchase since 2021.

According to a regulatory filing, the company acquired approximately 18,300 bitcoins between August 6 and September 12 for around $1.11 billion in cash, averaging $60,408 per bitcoin, including fees.

The latest acquisition brings MicroStrategy’s total Bitcoin holdings to approximately 244,800 BTC — worth over $14 billion at current prices — with an average purchase price of $38,585 per coin.

The Virginia-based company financed the acquisition through proceeds from the sale of common shares, following a recent 10-for-1 stock split aimed at making its shares more accessible.

MicroStrategy’s aggressive accumulation comes during a period of volatility in the crypto market. Bitcoin has been sliding over the last six months due to economic downturn fears, geopolitical tensions, and increased mining difficulties following an April code adjustment that halved miners' revenue potential.

However, BTC has recently rebounded, gaining over 8% in the past five days as favorable U.S. economic data and anticipated Federal Reserve rate cuts lifted sentiment.

MicroStrategy, led by co-founder and chairman Michael Saylor, first began accumulating Bitcoin in 2020 as a hedge against inflation.

Saylor’s strategy has made the company the largest corporate holder of the cryptocurrency, a move that continues to capture retail investor enthusiasm.

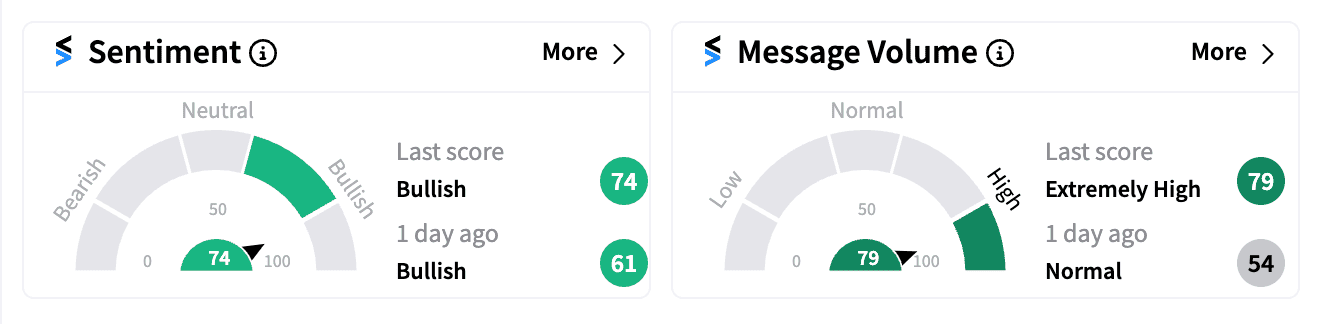

On Stocktwits, sentiment for MSTR turned more ‘bullish’ (73/100), with the stock among the top 10 trending tickers on the platform on Friday afternoon.

Bitcoin was last trading near $59,686, close to late August levels. Interestingly, MicroStrategy shares have more than doubled this year, significantly outpacing Bitcoin’s 34% gain.

As Saylor’s company continues to bet big on Bitcoin, retail investors seem poised to ride the wave alongside it.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)