Advertisement|Remove ads.

MSTR Stock Sees Retail Chatter Double Amid Bitcoin Slide – Stock Down 44% From Record Highs

Michael Saylor-backed Strategy (MSTR) slipped in pre-market trade on Friday, following a nearly 7% drop in the previous session.

The stock has dropped 44% since its record high in November 2024. Retail chatter on Stocktwits surged more than 134% over the past 24 hours as traders speculated whether the stock would extend its bearish streak amid continued weakness in Bitcoin (BTC). Over the past year, retail chatter around MSTR has jumped by more than 2,500%.

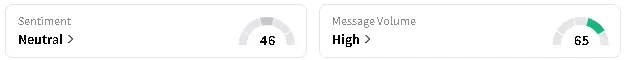

MSTR’s stock edged 0.17% lower in pre-market. However, retail sentiment around the stock improved to ‘neutral’ from ‘bearish’ territory with chatter at ‘high’ levels over the past day.

Meanwhile, Bitcoin’s price was down as much as 2%, trading around $109,244 after briefly dipping to $108,900 levels earlier in the session. Retail sentiment around the apex cryptocurrency also improved to ‘neutral’ from ‘bearish’ territory, and chatter increased to ‘high’ from ‘normal’ levels over the past day.

One Stocktwits user noted that the so-called “September effect” appears to be kicking in again. Also known in crypto circles as the “September curse,” this period has historically been challenging for cryptocurrencies. Despite this, Bitcoin has held up relatively well, down just 1.5% so far this month.

Another user expected the bearish trend to continue for Strategy’s stock.

Economist Peter Schiff predicted that it would be a “brutal bear market” for Bitcoin treasury companies like Strategy. “If not sure if any, including MSTR, will survive it,” he said on a post in X, calling the company strategy “harebrained.”

Strategy’s stock is holding onto gains of nearly 4% year-to-date, while Bitcoin’s price is up more than 17% this year despite dipping more than 12% from its record high of over $124,000 seen in August.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)