Advertisement|Remove ads.

Mullen Stock Tumbles After Bollinger Motors Unit Placed Under Court-Appointed Receivership: But Retail Stays Extremely Bullish

Shares of EV maker Mullen Automotive, Inc. (MULN) traded 27% lower on Tuesday afternoon after the company announced that its unit, Bollinger Motors, has been placed into court-appointed receivership.

The company said the U.S. District Court for the Eastern District of Michigan entered an order on May 7 placing its unit in receivership, and it has engaged legal counsel to challenge and resolve the issue.

The court’s action follows a legal complaint filed in March by Bollinger Motors founder Robert Bollinger, who alleged a breach of contract related to a $10 million secured promissory note. Bollinger became a majority-owned truck company of Mullen Automotive in September 2022.

Mullen, however, said that the promissory note at issue was not guaranteed, and Mullen is not obligated to fund any shortfall if Bollinger's assets are insufficient to cover its liabilities.

The court-appointed receiver now has full authority over Bollinger Motors’ operations and the ability to operate or sell the business for the benefit of creditors.

Mullen, however, said that it does not expect the loss of Bollinger Motors to have a material adverse impact on its liquidity or capital resources.

On Tuesday, Mullen also reported its first-quarter (Q1) earnings, with a net loss attributable to common shareholders of $47.08 million, down from the loss of $132.43 million recorded in the corresponding quarter of 2024.

While the company’s revenue from vehicle sales rose from $33,335 in the first quarter of 2024 to $4.95 million in the quarter through the end of March, the cost of revenues also ballooned from $13,440 to $7 million. The company’s net loss per share in Q1 was $489.24.

Mullen Automotive ended the quarter with total cash of $2.3 million. However, the company said it intends to reduce its cash outflow by cutting operating costs and restructuring liabilities.

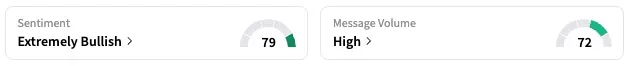

On Stocktwits, retail sentiment around MULN stayed unmoved within the ‘extremely bullish’ territory over the past 24 hours while message volume jumped from ‘normal’ to ‘high’ levels.

A Stocktwits user, however, expressed skepticism about the company.

https://stocktwits.com/Dww0311/message/615256724

MULN stock has lost nearly all of its value this year.

Also See: Boeing Gets A Price Target Hike From Bernstein After Historic Airplane Order From Qatar

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_market_OG_2_jpg_d58f0a637e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ray_dalio_resized_jpg_d2f1d535bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamie_dimon_jpmorgan_jpg_cbdd07fa63.webp)