Advertisement|Remove ads.

Opendoor’s Biggest Bull Says Stock Can Hit $500; CEO Confirms Tokenization Push

- Opendoor investor Eric Jackson said the stock could reach $500, raising his previous $82 target, and that patient investors would reap the rewards.

- CEO Kaz Nejatian confirmed Opendoor’s “tokenization” plans, but did not offer details.

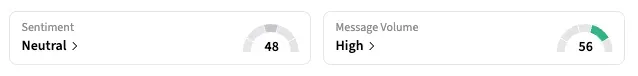

- Stocktwits sentiment for OPEN dropped to ‘neutral’ from ‘bullish,’ following a five-day stock slide.

Opendoor Technologies, Inc.’s shares rose 4.6% in early premarket on Thursday, after a sharp five-session slide amid the company’s warrant issue.

Meanwhile, the company’s most vocal bull, hedge fund manager Eric Jackson, has projected the stock could climb as high as $500, arguing that patient investors will ultimately be rewarded.

Jackson Urges Patience

“The road to $82 → $200 → $500 is untouched,” he said in a X thread on Wednesday, referencing his previous $82 stock target from July. Jackson’s bullish commentary at the time kicked off a multifold surge in OPEN.

Jackson argued that Opendoor’s growth strategy – driven by its new management, adoption of artificial intelligence (AI) across its offerings, tokenization plans, and steady marketplace gains – was in place and urged investors to dismiss the 28% stock slide over the past week.

“OPEN rallied +96% in 3 trading days after earnings,” Jackson said, referring to the rally just ahead of the company’s results last week. “You don’t go vertical like that without a digestion period… OPEN’s long-term trajectory didn’t change this week.”

He speculated that some investors sold the stock after receiving a free bundle of warrants, whose record date was Tuesday. “This is the math of a high-velocity stock with a brand-new warrant instrument attached to it… It’s just traders being traders.”

Retail Mood Dropping

On Stocktwits, the retail sentiment for OPEN shifted to ‘neutral’ as of early Thursday, from ‘bullish’ the previous day, signaling that retail investors might be losing patience.

“$OPEN I will sell some of my stake today and invest in $YYAI, this is the next one,” said one user, referring to shares of AiRWA, Inc., which recently pivoted fully to Web3 and crypto amid surging retail buzz.

So far this year, Opendoor’s stock is still up 318%.

CEO Confirms Tokenization Plans

Simultaneously, Opendoor CEO Kaz Nejatian seemingly confirmed the company’s “tokenization” plans. Although details remain sparse, retail and meme-stock investors speculate that the company may roll out tradable digital tokens tied to fractional ownership of homes and other real estate. Chatter also points to a potential introduction of stablecoin- or crypto-based payments on the Opendoor platform.

“We are not behind,” Nejatian said in an X post, in response to another about the company’s tokenization plans. “And the race isn’t to be first to launch. It is to be the winner.”

Zacks Equity Research published an investor note on Tuesday, praising the company’s AI efforts.

“Opendoor has launched more than a dozen AI-powered products in just weeks, including end-to-end AI home scoping, automated title and escrow workflows, multilingual AI valuation agents, and a revamped inspection system,” the firm said.

The tools have already reduced home assessments from nearly a day to about 10 minutes, and the number of employees needed in underwriting has been reduced from as many as 11 to just one. Consequently, weekly acquisition contracts for Opendoor doubled between mid-September and late October, Zacks noted.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)