Advertisement|Remove ads.

Mullen's Stock Plumbs New Depths After Q1 Net Loss Balloons By 46%, Retail Traders Throw In The Towel

Shares of Mullen Automotive Inc. (MULN) plunged nearly 28% on Wednesday, hitting new record lows after quarterly results showed widening losses that further dented retail investor confidence.

The struggling EV maker reported first-quarter (Q1) revenue of $2.9 million, stating that it produced more revenue this quarter than in the past two fiscal years combined.

However, net losses ballooned by over 46%, with a net loss of $114.9 million attributable to common shareholders after preferred dividends.

While adjusted losses per share narrowed to $661.33 from $91,940.42 a year earlier, the company noted that this figure accounted for retroactive reverse stock splits, including a 1:60 split that took effect this week.

Most losses were non-cash expenses totaling $91 million, making up 79% of the quarter's total loss.

CEO David Michery tried to highlight a positive milestone, saying that $4.4 million worth of invoices were issued and $6 million in vehicle payments were received, marking Mullen's strongest quarter to date.

The company's Bollinger segment completed the sale of 20 units, generating $2.8 million in revenue.

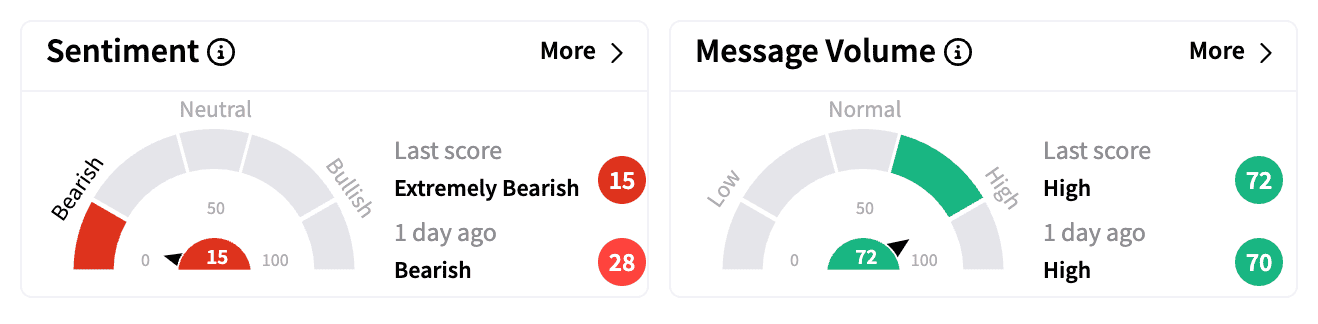

On Stocktwits, sentiment turned 'extremely bearish,' with message volume ticking up as traders weighed Mullen's financial strain.

One user pointed to Mullen's crippling balance sheet, noting that the company already owed a lot of money to GEM Group from a lost arbitration case.

"This is an insolvent company," the user concluded.

Another skeptical trader mocked potential buyers.

Mullen in December submitted a modified plan to the U.S. Department of Energy (DOE) seeking $55 million in matching funds to support U.S.-based battery and pack production.

Additionally, the company has implemented cost-cutting measures, reducing headcount and personnel costs by $13 million annually.

However, MULN stock has lost over 99% of its value in the past year, reflecting a sharp decline in investor confidence amid legal hurdles, financial distress, and lackluster sales growth.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)