Advertisement|Remove ads.

Luxury Wine Maker Duckhorn’s Stock Doubles On $1.95B Take-Private Deal: Retail Is Over The Moon

Shares of luxury wine maker Duckhorn Portfolio Inc. (NAPA) more than doubled on Monday as the company announced a $1.95 billion take-private deal by buyout firm Butterfly Equity at a price that is more than double the stock’s closing mark on Friday. Retail sentiment turned exuberant following the deal announcement.

Under the terms of the agreement, Duckhorn stockholders will receive $11.10 per share in cash, a premium of about 65.3% to the volume weighted average share price of common stock over the 90-day period ending on Oct. 4, the company said in a statement.

The agreement has a “go-shop” period of 45 days during which the company could court other offers, it said in a statement. The deal is expected to close in the winter and is subject to regulatory approval. JPMorgan Securities is advising Duckhorn on the deal.

Los Angeles-based Butterfly’s portfolio includes Milk Specialties Global, Chosen Foods, MaryRuth Organics, and QDOBA. Vishal Patel, a partner at Butterfly, said the firm liked Duckhorn’s “structurally advantaged” business model, management team and strong prospects for both strategic and inorganic growth.

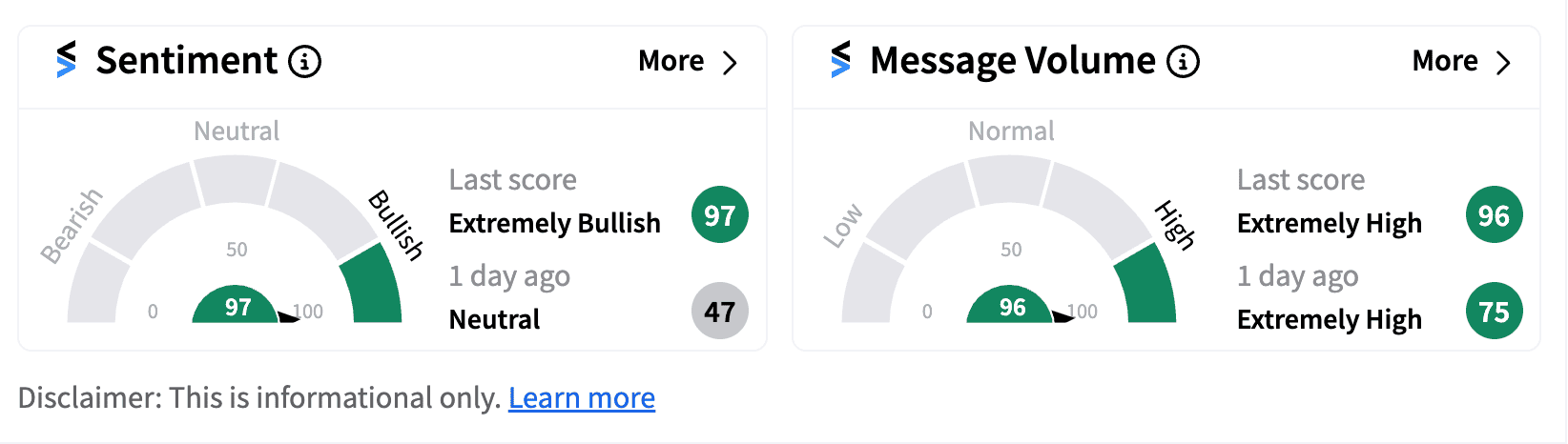

Retail sentiment expectedly turned ‘extremely bullish’ on the firm following the news.

Meanwhile, the company's fourth-quarter earnings were mixed. Duckhorn said its Q4 net sales clocked at $107.4 million for the three month period ending July 31, up 7.3% from a year earlier, beating analysts’ average estimate of $104.6 million. However, for the full year, the company’s sales rose just 0.7% to $405.5 million.

For the fourth quarter, the company’s net income dipped nearly 36.4% to $11.30 million while for the full year, the bottomline was down 19.14% to $56.02 million. Adjusted EPS for Q4 came in at $0.14, beating analyst estimates of $0.10.

Duckhorn was founded in 1976 and owns premium wine brands such as Decoy, Goldeneye, Sonoma-Cutrer and Kosta Brown. The firm operates 11 wineries, 10 wine-making facilities, and eight tasting rooms, and has over 2,200 acres of vineyards across 38 estate properties.

The stock is down nearly 45% this year, underperforming the broader S&P 500 and Nasdaq indexes.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263711678_jpg_7dcbe85e4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202237165_jpg_188d67bdb5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_2_jpg_0c6789db95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263736058_jpg_2b8f901978.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298120_jpg_ceb8c90666.webp)