Advertisement|Remove ads.

Nasdaq, S&P 500 Futures Climb As Market Eyes Yet Another Weekly Gain— Strategist Suggests Rally May Have More Legs

- The major averages are on track to record gains for a second straight week as earnings optimism and geopolitical concerns abate.

- With the government shutdown continuing, the release of the September consumer price inflation report, due Friday, has been temporarily suspended.

- The upcoming week could pose a key test for markets, given that several high-profile, heavily weighted tech names are due to announce quarterly results.

U.S. stocks are primed to close the week on an upbeat note, with the major index futures firmly in the green. All three major averages — the Dow Jones Industrial Average, the S&P 500 and the Nasdaq Composite — are on track to record gains for a second straight week as earnings optimism and geopolitical concerns abate.

Intel's (INTC) robust results, reported after the market closed on Thursday, should buoy sentiment toward the tech stocks in Friday's session. The upcoming week could pose a key test for markets, given several high-profile, heavily weighted tech names, including Apple (AAPL), Amazon (AMZN), Microsoft (MSFT) and Alphabet (GOOGL) (GOOG) are all due to announce their quarterly results.

How Futures Are Trading

As of 2 a.m. ET on Friday, the Nasdaq 100 and Russell 2000 futures rose about 0.35% and the S&P 500 and Dow futures rose 0.23% and 0.14%.

On Stocktwits, retail sentiment toward the SPDR S&P 500 ETF (SPY), an exchange-traded fund that tracks the S&P 500 Index, remained ‘bearish’ heading into Friday’s session. Retail also held a ‘bearish’ view on the Invesco QQQ Trust (QQQ) ETF, which tracks the Nasdaq 100 Index, although sentiment saw a modicum of improvement from the ‘extremely bearish’ mood seen a day ago. The message volume on both streams dropped to ‘normal’ levels.

How Markets Traded On Thursday

Stocks advanced notably on Thursday, as traders reacted to the news that high-level delegations from both China and the U.S. would thrash out differences over tariffs at a meeting to be held during the weekend in Malaysia. Trump also confirmed that he would meet with his Chinese counterpart, Xi Jinping, during his diplomatic trip to South Korea next week. Energy, industrial, IT, and materials stocks led from the front, while defensive sectors such as consumer staples, real estate, and utilities saw slight weakness.

The QQQ and SPY ETFs gained 0.44% and 0.59%, respectively. The iShares Russell 2000 ETF (IWM) rallied 1.27% and the SPDR Dow Jones Industrial Average ETF Trust (DIA) rose a more modest 0.32%.

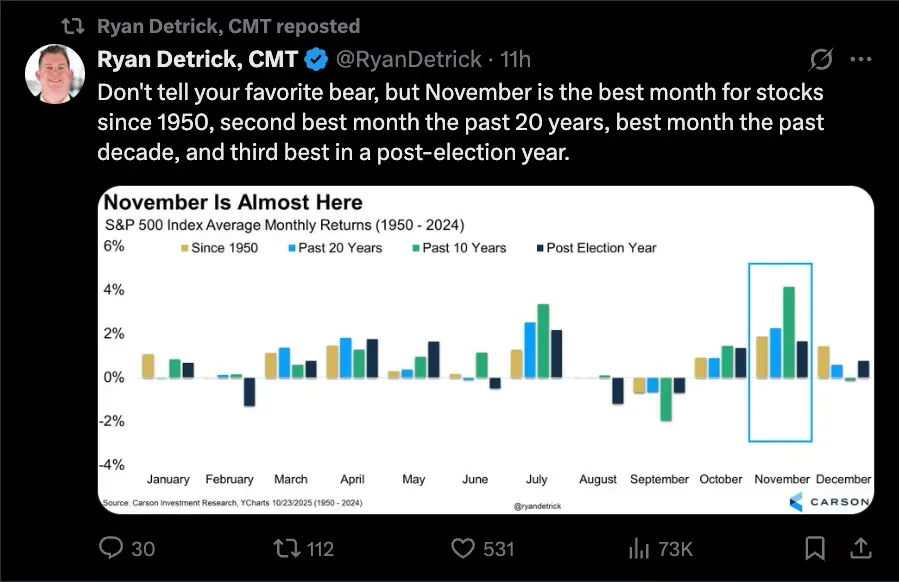

The outlook could be rosier, going by historical data shared by Carson Group Chief Market Strategist Ryan Detrick. He noted that “November is the best month for stocks since 1950, second best month the past 20 years, best month the past decade, and third best in a post-election year.”

Key Catalysts To Watch Out For

With the government shutdown continuing, the release of the September consumer price inflation report, due Friday, has been temporarily suspended. S&P is scheduled to release its flash manufacturing and services purchasing managers’ indices (PMIs) for October at 9:45 a.m. ET. The manufacturing PMI is expected to edge down to 51.8 from 52 in September, and the services PMI is estimated to have slipped to 54 from 54.2.

The University of Michigan’s flash consumer sentiment index for October is expected to edge down to 54.9 from September’s 55.

Booz Allen Hamilton (BAH), General Dynamics (GD), Illinois Tool Works (ITW), and Procter & Gamble (PF) are among the companies reporting their quarterly results before the market opens on Friday.

How Other Markets Fared

Crude oil futures slipped amid profit-taking early Friday, following the week’s substantial advance. On Thursday, oil settled up 5.6% on Trump’s sanctions against Russian oil companies. Gold futures also pulled back. The 10-year U.S. Treasury note is marginally higher early Friday following Thursday’s rise. The U.S. dollar was slightly firmer against other major currencies.

Most major Asian markets advanced, encouraged by Wall Street’s firmer close overnight, but the Australian, Taiwanese, and Indian markets experienced losses.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)