Advertisement|Remove ads.

Neel Kashkari Joins Rate Cut Camp, Sees Two Cuts As ‘Appropriate’ In 2025

Neel Kashkari, the president of the Federal Reserve Bank of Minneapolis, said Thursday that the U.S. economy is slowing and that it’s not clear what impact President Donald Trump’s tariffs will have on inflation.

However, it “still may be appropriate in the near term to begin adjusting policy rate,” he said in an interview with CNBC. According to him, two rate cuts this year “still seems appropriate.”

He stated that the central bank needs to respond to the slowing economy, noting that “If inflation does rise because of tariffs, the Fed could pause or even hike [rates].”

In earlier comments, Kashkari had thus far maintained that the Federal Reserve should keep interest rates steady, citing the uncertainty caused by the ongoing trade and tariff tensions. He described it as putting the Fed “on edge” due to potential inflation risks.

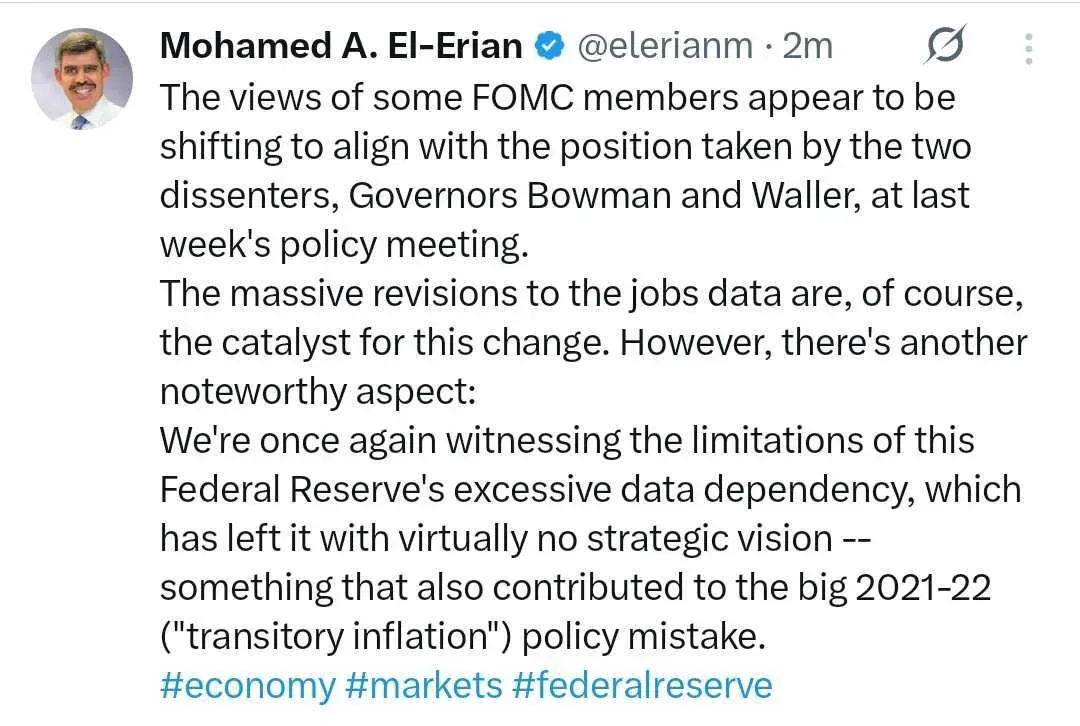

Wednesday’s remarks mark a pivot from his earlier stance to take a more cautious, wait-and-watch approach to the economic environment. Noted economist Mohammed El-Erian noted the shift aligned with the position expressed by the two dissenters during the FOMC’s latest meeting, Governor Michelle Bowman and Kevin Waller.

“We're once again witnessing the limitations of this Federal Reserve's excessive data dependency, which has left it with virtually no strategic vision -- something that also contributed to the big 2021-22 ("transitory inflation") policy mistake,” he said in a post on X.

Talking about Trump’s recent firing of the Bureau of Labor Statistics (BLS) chief, Kashkari noted that while he doesn’t wish to comment on the President’s decisions, he does not doubt the integrity of the BLS jobs data. “Ultimately, you cannot fake economic reality,” he said.

The U.S. equity market opened in the green on Wednesday. The SPDR S&P 500 ETF (SPY) was up 0.18%, while the SPDR Dow Jones Industrial Average ETF (DIA) gained 0.02%. The Invesco QQQ Series 1 Trust (QQQ), which tracks the tech-heavy Nasdaq 100, was up 0.31%. On StockTwits, retail sentiment around the S&P 500 ETF remained in ‘neutral’ territory.

Read also: Apollo Targets Data Center Growth With Stream Acquisition Deal: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)