Advertisement. Remove ads.

Gold Miner Newmont’s Stock Eyes 3rd Day In The Red After Earnings Miss: Retail Divided

Shares of Newmont Corp. ($NEM) fell more than 3% on Friday, setting the stage for a third consecutive day of losses.

The decline follows a nearly 15% plunge in the previous session, reportedly marking the stock’s worst day in nearly 16 years.

This sharp drop was triggered by disappointing third-quarter results released late Wednesday, which showed adjusted EPS of $0.81, falling short of Wall Street’s expectation of $0.86. Revenue also missed the consensus estimate of $4.67 billion, coming in at $4.61 billion.

These figures came despite Newmont reporting an average realized gold price of $2,518 per ounce for the quarter versus $1,920 a year earlier.

Expectations had been high for precious-metals miners due to a rally in gold and silver prices in recent months, fueled by geopolitical instability and declining interest rates globally.

However, gold prices dipped on Friday as some investors locked in profits following a rally that had pushed bullion to a record high of $2,758.37 earlier in the week.

Adding to the pressure, Scotiabank downgraded Newmont’s rating to ‘Sector Perform’ from ‘Outperform', cutting its price target to $55 from $59. Analysts noted that the company’s high-level 2025 operating guidance fell short of expectations, contributing to the stock’s significant decline.

Scotiabank believes Newmont shares will face headwinds in the near term and may remain under pressure until more clarity is provided, potentially not until 2025.

Conversely, Raymond James raised its price target for Newmont to $66 from $65 while maintaining an ‘Outperform’ rating. The firm emphasized that Newmont offers investors a solid opportunity in gold with lower jurisdictional risks and a global portfolio that generates strong cash flow, supported by a robust balance sheet.

Tom Palmer, Newmont’s President and CEO said that the company is on track to meet its production guidance for 2024, expecting attributable production of 1.8 million gold ounces in Q4 at an all-in sustaining cost of $1,475 per ounce.

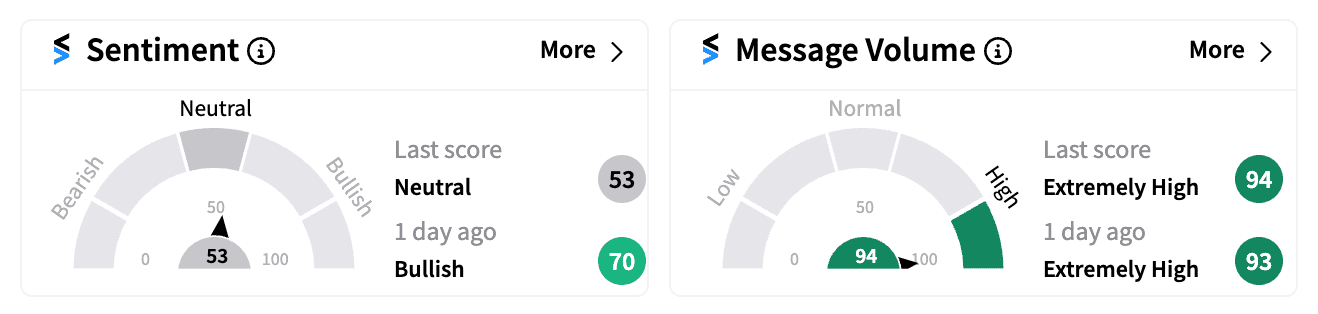

On Stocktwits, retail sentiment for Newmont shifted to ‘neutral’ levels after being ‘extremely bullish’ the previous day, with message volumes surging nearly 250% in the 24 hours to Thursday.

Some bullish users suggested that the market was overreacting and this would be a dip worth buying.

Others said gold would have offered better returns than miners themselves and expressed skepticism about management’s ability to steer the company effectively.

NEM stock is still up nearly 17% year-to-date, although it is underperforming compared to broader market indices.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_ny_motor_show_resized_jpg_2372b47562.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_lights_original_jpg_db38183cfe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_jpg_6c4cc95d17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/11/advertising.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/10/csr-corporate-social-responsibility-2024-10-528edecbe166c0116ce7a40a97faa6ff.jpg)