Advertisement|Remove ads.

Neonode (NEON) Stock Soars to New High Amidst Legal and Strategic Advancements

Neonode (NASDAQ: NEON), renowned for its optical sensing technologies, has reached a new 52-week high, with its stock soaring to $11.92—a remarkable increase of 589.02% over the past year. This surge reflects significant investor confidence in the company’s evolving business strategy and prospects in its potentially lucrative legal battles vs. Samsung (OTC: SSNLF) and Apple (NASDAQ: AAPL).

Neonode’s (NASDAQ: NEON) recent financial disclosures and strategic shifts have played a crucial role in this dramatic uptick. For the second quarter ending June 30, 2024, Neonode reported revenues of $1.4 million, marking an 18.7% increase from the previous year. However, the company’s net loss widened to $1.7 million from $1.5 million last year. Despite these losses, Neonode has made notable progress in its cost management and operational efficiency.

A pivotal development is Neonode’s transition from a product-centric approach to a licensing model. In May 2024, the company signed a significant licensing agreement with YesAR, a Chinese firm specializing in holographic displays. This move aligns with Neonode’s broader strategy to leverage its technological assets through licensing rather than direct product sales.

“We continue to see promising licensing opportunities for our touch and touchless human-machine interaction solutions. The demand for these technologies, especially in autonomous driving and industrial automation, remains strong,” said Fredrik Nihlén, Neonode’s interim CEO.

Nihlén’s appointment follows the departure of Dr. Urban Forssell, who remains a strategic advisor until the end of 2024.

Update on Legal Battles with Samsung and Apple

Neonode’s legal battles with major tech giants Samsung (OTC: SSNLF) and Apple (NASDAQ: AAPL) are also contributing to its robust stock performance. The company is engaged in a high-stakes lawsuit over its slide-to-unlock patent, which is crucial for its future financial prospects. According to Andreas Iwerbäck, a patent expert interviewed by Redeye, there is a high likelihood of a settlement with Samsung, potentially worth billions. Iwerbäck confidently predicts that Samsung will settle before trial, suggesting that the settlement could be finalized within days or weeks.

Source: Redeye

The litigation with Apple, however, is expected to be more complex. Analysts suggest that a successful outcome could significantly impact Neonode’s stock value, with estimates suggesting that a favorable settlement could increase the share price to as much as $121.

“Investors are showing strong confidence in our strategic shift, and we believe this is just the beginning,” Nihlén remarked.

Impact of Legal Outcomes on NEON Stock Value

Redeye’s recent evaluation has raised Neonode’s fair value estimate to $37 per share, highlighting the potential impact of the ongoing legal battles. The company’s position is further bolstered by the reversal of a district court ruling in its favor, which has improved its chances against both Samsung and Apple.

Looking ahead, Neonode appears to be at a critical juncture, balancing its strategic pivot with high-stakes legal disputes. While the path forward involves navigating potential market volatility and the uncertainties of its lawsuits, the company’s innovative technologies and strategic initiatives are positioning it for potential long-term success.

With its stock riding high and significant legal decisions on the horizon, Neonode is set to redefine its future in the tech landscape, potentially transforming its market standing and investor returns.

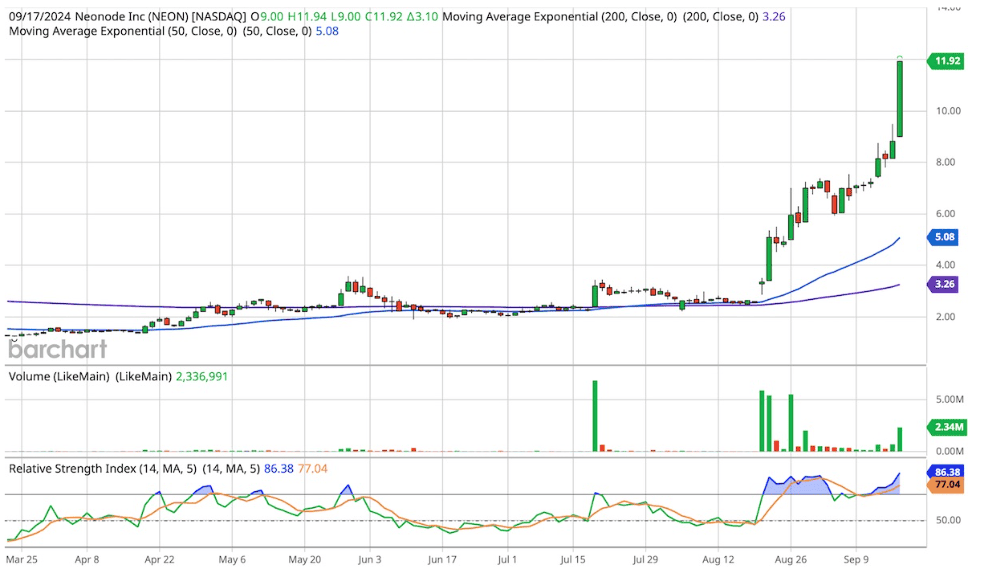

Neonode (NEON) Stock Price Action

Neonode stock soared another 35.15% today to close the day at $11.92 per share.

YTD, NEON stock is up 416.02%. Over the past year, NEON stock is up 589.02%.

Despite Neonode’s massive gains to date, it could be argued that NEON stock still has substantial potential upside given the recent developments with its case against Samsung and the big increase in valuation a win would bring.

A win in the more difficult case vs. Apple would be the cherry on top.

Neonode (NASDAQ: NEON) six-month interactive stock chart. (Source: Barchart)

View Neonode Interactive Stock Chart on Barchart

Join the Discussion in the WVC Facebook Investor Group

Have a Stock Tip or New Story Suggestion? Email us at Invest@WealthyVC.com

Disclaimer: Wealthy VC does not hold a long or short position in any of the stocks, ETFs or cryptocurrencies mentioned in this article.

This article was written by an independent contributor and does not reflect the views of Stocktwits. It has not been edited for content. The information provided here is intended solely for informational and educational purposes, and should not be interpreted as investment advice. Stocktwits does not endorse the purchase or sale of any security nor does it make any claims about the financial status of any company.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)