Advertisement|Remove ads.

NerdWallet Stock Gains After The Closing Bell On Q4 Revenue Beat: Retail’s Elated

NerdWallet Inc (NRDS) shares rose 7.9% in aftermarket trade on Wednesday, as the company’s fourth-quarter revenue topped Wall Street’s estimates.

The personal finance company’s fourth-quarter revenue jumped 37% to $183.8 million compared to the year-ago quarter. Analysts, on average, expected the company to post $168.3 million in revenue.

The company reported a net income of $38.6 million for the fourth quarter, compared to a loss of $2.3 million last year.

NerdWallet helps users compare credit cards, loans, and mortgages and receives compensation from partner financial institutions. It is available in the U.S., the United Kingdom, Canada, and Australia.

Its insurance unit revenue soared to $72 million, driven by strong growth in auto insurance products as carriers expanded budgets.

However, credit card revenue fell 19% to $35 million as organic search traffic declined.

The company’s average monthly unique user (MUU) count fell 20% to 19 million compared to last year as weakness persisted in search traffic for non-monetizing “learn” topics. However, the company said it did not affect its product marketplaces or other channels.

The company expects year-over-year traffic decline to worsen in the first quarter before stabilizing and returning to growth by early 2026.

NerdWallet said it would transition away from the MUU metric, which does not reflect the company’s present focus on increasing the number of more engaged users.

Its loan revenue declined 26% to $17 million due to a decrease in personal loans which was slightly offset by a rise in mortgage loans.

“While the lending environment remained tight and a headwind for both consumer and small business loans (SMB) as well as credit cards, we believe we could

see improvement during 2025,” the company said in a statement.

NerdWallet expects to post 2025 operating income between $50 million and $60 million.

The San Francisco-based company also named former Blackstone executive John Lee its chief financial officer. Lee will take charge on March 17.

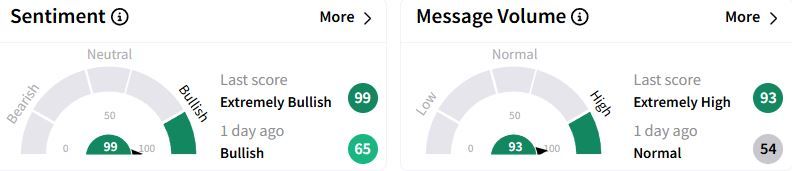

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (99/100) territory from ‘bullish’(65/100) a day ago, while retail chatter rose to ‘extremely high.’

Over the past year, NerdWallet shares have fallen 14.5%.

Also See: Grab Holdings Stock Tumbles Aftermarket On Tepid 2025 Revenue View: Retail Confidence Undeterred

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_xi_jinping_jpg_f2aa8420ba.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2219995127_jpg_47fff50a9f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244386520_1_jpg_e364bca397.webp)