Advertisement|Remove ads.

Nestle India Q2 Preview: Analyst Sees Over 10% Upside If Results Beat Street Estimates

Nestle India shares ended nearly 4% higher on Wednesday ahead of its Q2 earnings report on October 16.

Revenue growth is seen at 8–10% year-on-year (YoY), while profits are likely to rise 6-8% in the September quarter (Q2). Margins are expected to come around 21-22%. Investors will be closely watching commentary on margins, volumes, and forward guidance.

If results are better than expectations, a short-term rally could be seen towards ₹1,320–₹1,350, according to SEBI-registered analyst Deepak Pal. On the other hand, a negative earnings surprise could drag Nestle stock towards ₹1,100.

In recent quarters, the company has shown steady revenue growth (7–10% YoY). Operating margins have been hit by input cost inflation (milk, coffee, cocoa), but pricing power and management efficiency have offset some of this impact. This quarter’s results will largely depend on volume growth and a recovery in rural demand.

Nestle’s focus is now on rural penetration and new premium product launches, which can sustain strong growth momentum in the future.

Nestle: What are technical charts showing?

The stock is recovering from oversold levels and trading near its short-term moving averages. The chart shows Nestle stock recently experienced a sharp fall (from ₹2,500 to ₹1,170) and has since started forming a base.

On the downside, Pal identified immediate support at ₹1,150, which, if held, could help the stock rebound. Next support is seen at ₹1,100. On the upside, immediate resistance is seen at ₹1,250; short-covering may face resistance here. Next resistance levels are identified at ₹1,320–₹1,350. Pal added that if Q2 results are positive, this becomes the target zone.

Investment strategy: What should traders do?

Pal said that for a quality FMCG company like Nestle, a gradual accumulation strategy is wise. Result volatility offers opportunities for short-term traders, while long-term investors can use this phase to accumulate if a trend reversal is confirmed.

In the short term, the ideal buy range is between ₹1,150 and ₹1,180, with potential targets of ₹1,320–₹1,350, suggesting a result-driven rally may occur. For the medium term, accumulation within ₹1,100–₹1,150 could lead to recovery targets of ₹1,450–₹1,500 after the results.

Long-term investors might consider the ₹1,050–₹1,150 range, eyeing ₹1,700–₹1,800 as potential targets, as the company remains a quality FMCG choice for any portfolio.

How to play the Q2 earnings report for Nestle?

According to Pal, a positive surprise, driven by higher volume growth, rural recovery, and margin expansion, could trigger a gap-up opening and a rally beyond ₹1,300.

If results turn out neutral or mixed, moderate growth and margin pressure may keep price movement sideways, testing resistance near ₹1,250–₹1,300. On the other hand, a disappointing outcome, led by weak urban demand, elevated costs, or subdued guidance, could push the stock down toward ₹1,000–₹1,100 support levels.

Pal concluded that Nestle India is a strong brand with a stable business model and a deep product portfolio, but it faces headwinds from high input costs and soft urban demand. He advised traders to watch technical supports at ₹1,150 and resistances at ₹1,250–1,300. Short-term traders should play volatility; long-term investors can gradually accumulate if a trend reversal is clear.

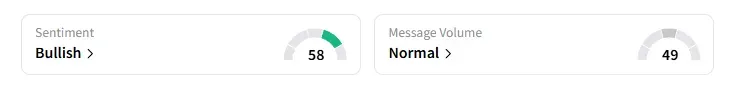

What is the retail mood on Stocktwits?

Data on Stocktwits showed that retail sentiment turned ‘bullish’ a day ago on this counter.

Nestle India shares have risen 12% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)