Advertisement|Remove ads.

Netflix Reportedly Aims For Trillion-Dollar Status By 2030 With Lofty Revenue Goals: Retail Stays Bullish Ahead Of Q1 Print

Los Gatos, California-based Netflix. Inc. (NFLX) is reportedly eyeing the exclusive $1 trillion market-cap club, buoyed by strong fundamentals.

As of Monday’s close, Netflix's market cap was $398.362 billion, a fair distance from its peak valuation of around $455 billion in mid-February.

It is currently the 18th biggest company in terms of valuation.

According to the Wall Street Journal, Netflix executives exuded optimism about the company's growth prospects at an annual business review meeting last month.

The report, citing people who attended the meeting, noted that the company plans to double revenue by 2030 from the $39 billion reported for 2024, with ad sales likely coming in at $9 billion.

Netflix also wants to triple its operating income from 2024's $10 billion in the same time frame.

The streaming giant began cracking down on password sharing in May 2023, and its subscriber numbers have surged since then.

The fourth-quarter (Q4) report released in January showed its global streaming paid net additions jumping to 18.91 million from 13.12 million a year earlier and 5.07 million in the previous quarter.

The total global streaming paid membership stood at 301.63 million at the end of the quarter.

Last week, Morgan Stanley named Netflix its top media and entertainment pick, swapping positions with Walt Disney Co. (DIS). The firm cited Netflix's relative immunity in a weaker global environment.

The Journal said that Netflix executives acknowledged the likelihood of a U.S. recession at the meeting but were optimistic that the company could be less affected if people watch shows and movies indoors.

Netflix is scheduled to report its first-quarter results on Thursday. Finchat-compiled consensus estimates call for earnings per share (EPS) of $5.74 and revenue of $10.51 billion.

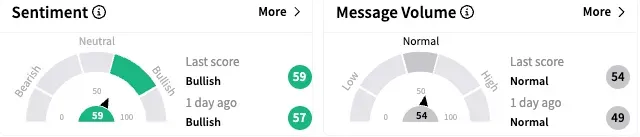

On Stocktwits, retail sentiment toward Netflix stock remained 'bullish' (59/100), and the message volume stayed 'normal.'

A bullish watcher braced for a positive earnings report and a potential stock split announcement.

Another user said they were accumulating more shares ahead of earnings.

Netflix ended Monday's session up 1.41% at $931.28 and climbed 1.26% in the after-hours session.

The stock is up nearly 4.5% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_4_jpg_bb96bc484b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)