Advertisement|Remove ads.

Netflix Dips Despite Upbeat Earnings But Stock Gets Strong Backing From Retail Investors

Netflix shares tumbled 5% during midday trading on Friday, but retail user messages on Stocktwits surged over 900% in the last 24 hours, as chatter intensified following the streaming service company's annual forecast raise and upbeat second-quarter earnings.

The company reported earnings per share of $7.19, beating estimates of $7.09, according to data compiled by Fiscal AI. The company's revenue came in at $11.08 billion for the second quarter, topping expectations of $11.06 billion.

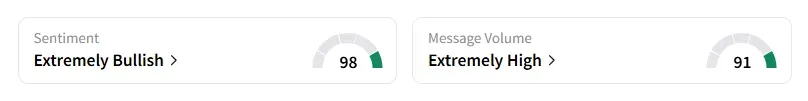

Retail sentiment on the stock remained ‘extremely bullish’, with chatter at ‘extremely high’ levels, according to Stocktwits data.

Netflix attributed the steady results to favorable foreign exchange trends, the strategic timing of expenses, and strong content performance, citing the successful release of several hit series, including Squid Game Season 3, Sirens, and Ginny & Georgia Season 3, as key drivers.

Several brokerages raised their price targets on Netflix following the company's second-quarter (Q2) earnings, with UBS analyst John Hodulik expecting new content and investments in live programming to support engagement growth going forward.

A bullish user noted that the stock was oversold and should recover later.

Brokerage Jefferies raised Netflix’s price target $1,500 from $1,400 and has maintained a ‘Buy’ rating. Jefferies analyst James Heaney called the results "solid" and featured "no Q2 surprises."

The firm was "most encouraged" to see revenue growth in the United States and Canada accelerate to 15% year-over-year, which suggests limited churn from the recent price increases, Heaney added.

The analyst said the company can sustain earnings per share growth of 20% or more over the next three to five years.

A Stocktwits user stated that it was a solid earnings beat, and the share price drop was an overreaction.

Investors were concerned that the annual revenue forecast raise was more a result of a weaker dollar and not driven by Netflix’s content demand.

Netflix shares have risen by over 36% year-to-date and have increased by 91% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Retail Bulls Rally Behind Trump Jr.-Backed GrabAGun Even As Stock Halves After NYSE Debut

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215875671_jpg_b63edc641f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229940320_jpg_5bc20a70df.webp)