Advertisement|Remove ads.

New Fortress Energy Stock Surges On $4B Puerto Rico Deal LNG Supply Deal

New Fortress Energy stock (NFE) jumped over 35% in extended trading on Tuesday after the company confirmed that it has struck an agreement to sell liquefied natural gas to Puerto Rico.

Earlier in the day, Puerto Rico's Governor Jenniffer Gonzalez said that the company has agreed to supply LNG for seven years, with a total contract value of about $4 billion. The stock jumped about 45% on Tuesday, to log its best day ever.

In July, the Financial Oversight and Management Board had rejected an initial $20 billion contract, which would have spanned 15 years. However, in August, U.S. President Donald Trump fired six of the seven members of the body that oversees the territory's finances.

“After an exhaustive negotiation, we were able to substantially modify the agreement with NFE, which provides notable savings for the treasury and more protection for the people,” Gonzalez said. Puerto Rico relies on fuel imports to power the island and has often faced problems with electricity.

The agreement will provide a much-needed boost to the troubled LNG firm, which has been grappling with project delays and a low credit rating, resulting in higher natural gas acquisition costs.

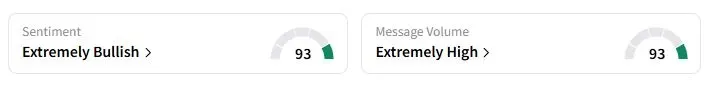

Retail sentiment on Stocktwits about New Fortress was in the ‘extremely bullish’ territory at the time of writing. The stock has seen a 1,850% surge in message volume over the past 24 hours.

Separately, New Fortress said that up to 75 trillion British thermal units of natural gas per year can be supplied through an agreement, with minimum annual take-or-pay volumes of 40 TBtu, rising up to 50 TBtu if certain conditions are met. The company will ship the LNG from its Altamira facility in Mexico.

"Puerto Ricans pay far too much for electricity today, and this long-term agreement provides cheaper and cleaner fuel for existing power plants for years to come," NFE's CEO Wes Edens said.

One optimistic trader noted that if the U.S. Federal Reserve delivers a 50-basis-point cut, the stock could “explode.”

New Fortress stock is still down 87% this year. The company has continued to post large losses so far this year, while its long-term debt remains elevated.

Also See: BHP To Cut Jobs, Suspend Operations At Queensland Coal Mine On High Tax Burden

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235745938_jpg_f29c2bc96f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244949316_jpg_a5294e121e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_logo_resized_9e8a8a2333.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_celsiusholdings_resized_jpg_5617397fa8.webp)