Advertisement|Remove ads.

BHP To Cut Jobs, Suspend Operations At Queensland Coal Mine On High Tax Burden

BHP Group (BHP) is reportedly set to suspend operations and reduce staff at a Queensland coking coal mine, as it grapples with low prices and high government royalties.

According to a Reuters News report, citing the firm, Saraji South, part of the Saraji Mine Complex that BHP runs with a unit of Mitsubishi, will be placed into care and maintenance from November 2025. The coking coal output from the Saraji complex stood at 8.2 million metric tons in the year to June 2025, the report stated.

The BHP Mitsubishi alliance also owns four other mines in Queensland that produce coking coal, an essential element in steelmaking.

"As joint owners of BMA, BHP and Mitsubishi Development do not want to see operations paused or jobs lost, but these are necessary decisions in the face of the combined impact of the Queensland Government’s unsustainable coal royalties and market conditions ," BMA Asset President Adam Lancey said, according to the report.

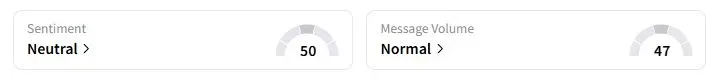

Retail sentiment on Stocktwits about BHP was in the ‘neutral’ territory at the time of writing.

BHP reportedly said that medium-term demand for hard coking coal remains strong. However, the mining giant believes that maintaining operations in lower-margin areas of the mine footprint was unsustainable under current conditions. The miner had already sold two metallurgical coal assets in 2023 for at least $3.2 billion in a move away from coal toward energy transition metals.

The coking royalties were imposed in 2022 when coal prices had soared following Russia’s invasion of Ukraine. However, now coking coal prices have slipped back to around $190 per ton, compared to above $600 per ton in 2022. According to a Bloomberg News report, the miner faced an effective tax and royalty rate in Queensland of 67% in the 12 months to June.

BHP stock has gained 9.9% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)