Advertisement|Remove ads.

Newmont Sells Entire Orla Mining Stake For $439 Million: Retail’s Unimpressed

Newmont Corp. (NEM) has fully divested its stake in Orla Mining following the sale of 43 million common shares of the company on the Toronto Stock Exchange.

The shares traded at $10.14 each, generating Newmont's gross proceeds of approximately $439 million (roughly C$605 million). Immediately before the transaction, Newmont held approximately 13.3% of Orla’s outstanding shares.

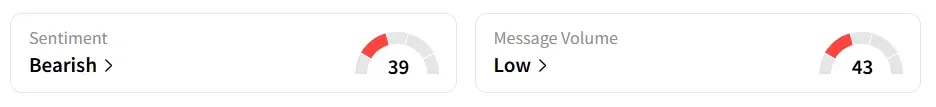

Following the divestiture announcement, Newmont stock traded over 4% higher on Friday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory. Message volume shifted to ‘low’ from ‘normal’ levels in 24 hours.

The move is part of Newmont’s ongoing effort to simplify its equity holdings and free up cash for its strategic priorities.

“Today’s announcement demonstrates Newmont’s ongoing commitment to streamlining our equity portfolio and unlocks significant cash to support Newmont’s capital allocation priorities,” said Newmont’s CEO, Tom Palmer.

So far in 2025, the company has generated about $900 million in after-tax proceeds from the sale of equity holdings. On September 10, Newmont applied for a voluntary delisting of its common shares from the Toronto Stock Exchange (TSX), which is expected to be effective on or about the close of trading on September 24.

UBS has increased its price target for Newmont from $70 to $92 and reaffirmed a ‘Buy’ rating on the stock, as per TheFly. The firm remains optimistic about the outlook for copper, aluminum, and gold.

Newmont is a gold producer and also mines copper, zinc, lead, and silver. It operates in mining regions across Africa, Australia, Latin America and the Caribbean, North America, and Papua New Guinea.

Newmont stock has gained over 118% in 2025 and over 52% in the last 12 months.

Also See: Paramount Skydance Likely Preparing $22 To $24 Per Share Bid For Warner Bros. Discovery: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)