Advertisement|Remove ads.

Pro-Trump Newsmax Recovers From Tariff Sell-Off After Q1 Audience Jumps 50% YoY: Retail Is On Wait-And-Watch Mode

Newly listed Newsmax, Inc. (NMAX) stock rallied nearly 5% on Monday despite the broader market ending a volatile session modestly lower.

Boca Raton, Florida-based Newsmax, which functions as a television broadcaster and multi-platform content publisher, announced Monday that its total audience climbed 50% year over year (YoY) in the first quarter.

Citing data from audience measurement firm Nielsen, Newsmax said its total first-quarter viewers were 22.4 million. On a sequential basis, the viewership climbed 15%.

Jason Villar, Vice President of Media and Market Research at Newsmax said, "These strong surges in audiences rarely happen in cable news.”

“We are clearly bucking the trend of cable news and overall cable viewership as viewers clearly like the product Newsmax is offering."

The company also said it plans to continue to grow its reach on the Newsmax channel, digital channel N2 as well as its streaming service Newsmax+.

Right-leaning media outlet Newsmax made its Wall Street debut on Monday. Through the initial public offering (IPO) under Regulation A+, the company raised the maximum allowed $75 million through the sale of 7.5 million shares of Class B Common Stock at an offer price of $10.00 per share.

A Regulation A+ IPO, aka mini-IPO, allows companies to raise capital through public offerings with less stringent requirements than a traditional IPO, enabling startups and smaller businesses to access funding more easily.

The company also previously completed a private preferred stock offering in February, raising $225 million.

Separately, on Monday, the company announced a standby equity purchase agreement with YA II PN, Ltd. that provides the latter the option but not obligation to purchase up to $1.2 billion worth of ordinary shares in Newsmax.

The agreement has a term of 24 months.

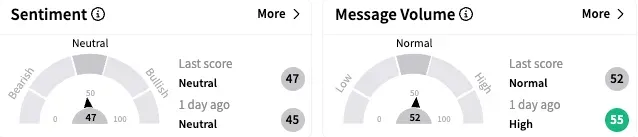

On Stocktwits, retail sentiment toward Newsmax stock remained ‘neutral’ (45/100) by late Monday and the message volume toned down to ‘normal’ levels.

A bearish watch predicted a stock drop to $20.

Another user, who identified as a conversative watcher said the stock is a solid investment, given its coverage aligns with their ideology.

Newsmax stock ended at $83.51 on its debut session, a 735% jump from the IPO price of $10. The stock tacked on another 180% on Tuesday before ending at $233.

As the euphoria faded, the stock pulled back in the very next session before the broader market negativity due to President Donald Trump’s dragged down the stock further.

It bottomed at $42.33 on Friday before staging a recovery.

In Tuesday's premarket session, the stock rose over 10% to $51.88.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Super Micro Stock Sees 400% Jump In Activity On Stocktwits As Trump Tariffs Roil Market

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)