Advertisement|Remove ads.

Nifty IT Index Slips Amid Weak Earnings, Global Headwinds — But Retail Sentiment Remains Bullish

Indian IT stocks took a sharp beating in trade on Thursday, dragged down by disappointing earnings from Wipro and cautious investor sentiment ahead of Infosys' quarterly results due later in the day.

The Nifty IT index was among the top sectoral laggards, falling nearly 2% intraday and extending year-to-date (YTD) losses to 24%, weighed down by global macroeconomic uncertainty triggered by U.S. President Trump's tariff measures.

Among individual stocks, Wipro disappointed Dalal Street after mixed earnings and gloomy guidance frayed investor nerves. For the first quarter of FY26, the IT giant expects revenue to shrink between 3.5% and 1.5% in constant currency terms.

Last week, Tata Consultancy Services (TCS) also missed Wall Street expectations on both revenue and margin fronts for the March quarter. It reported its slowest revenue growth in four years.

All eyes are now on Infosys, which is set to report its March quarter earnings post-market hours. The Street is watching closely for topline performance and commentary around FY25 revenue growth guidance, deal pipeline, and client spending trends.

Infosys' outlook will be crucial, especially amid concerns over delayed decision-making and budget tightening by global clients.

Meanwhile, midcap IT stock Sonata Software slumped over 7% after the company issued a weak revenue growth warning for its international IT services business.

In a regulatory filing, Sonata's management stated that revenues from its largest client will likely be lower than anticipated due to the ongoing tariff wars. Sonata's overseas operations accounts for approximately 25% of the firm's total revenue.

With growth visibility still cloudy and margin pressures persisting, the current earnings season suggests the IT sector may take longer than expected to bounce back to consistent double-digit growth.

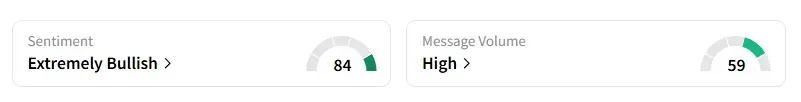

However, data from Stocktwits indicates retail sentiment remains 'extremely bullish.'

SEBI-registered analyst Orchid Research said on Stocktwits that the Nifty IT index around the 35 mark presents a promising opportunity.

While Wipro's results were below expectations, Orchid said the Street took comfort in improving margins — a key concern for the sector over the past two years.

According to the analyst, Wipro's margin performance marked a positive surprise despite volatility from large deal executions.

Given this trend, Orchid suggests it may be a good time to consider a SIP-style approach or adopt a 'buy on dips' strategy in ITBEES, an exchange-traded-fund (ETF), offering exposure to top Indian IT companies.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233231242_jpg_8d76eb3b7a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sarepta_cf8e97de31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)