Advertisement|Remove ads.

Nifty Reclaims 24,500 After Nearly 5 Months: SEBI RA Sees Bullish Setup With Resistance At 24,600-24,800

Indian stock markets held their ground as they resumed trade on Friday, with headline indices showing early strength.

Around 9:40 am IST, the benchmark Nifty reached 24,526, and the Sensex climbed by 769 points to 81,012. However, broader market performance lagged.

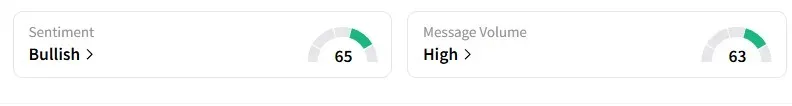

With the Nifty reclaiming the 24,500 level for the first time since Dec. 17, Stocktwits data showed that sentiment around the index remained 'bullish' early Friday.

Sectorally, banks, auto, and oil and gas led gains, while pharma, FMCG, and consumer durables witnessed some selling.

M&M, Maruti and Tata Motors gained between 1% and 3% after Mahindra overtook Hyundai and Tata Motors to become the second-largest carmaker in domestic sales for April. Maruti retained the top spot.

Eicher, Bajaj, and Hero shares are under pressure on weak sales growth in April.

Zomato parent Eternal's shares recouped opening losses to gain 2%, despite a 78% drop in Q4 profits. The company flagged intensifying competition, but Citi maintained a 'Buy' rating and raised the target price to ₹290, implying a 25% upside from current levels.

Adani Ports gained 5%, and Adani Enterprises saw 2% gains as investors cheered stellar Q4 earnings.

PNB Housing Finance spiked 6% amid reports of a large block deal. Quality Investment Holdings PCC is said to be offloading its entire 10.44% stake.

Investors will also monitor Marico, Godrej Properties, Indian Overseas Bank, Jindal Saw, and Gravita India as they report quarterly numbers later in the day.

SEBI-registered research analysts shared the day's trade setup on Stocktwits.

Mayank Singh Chandel believes the overall market structure remains bullish, with higher highs and higher lows on the daily chart.

However, resistance in the 24,450–24,500 range continues to cap upward movement, while immediate support is found between 24,200 and 24,300.

He sees a breakdown below this support, pushing the index decline toward 24,000.

Chandel highlights key monitoring levels: resistance at 24,450, 24,600, and 24,800, and support at 24,300, 24,200, and 24,000. Observing the early trend and open interest buildup will be crucial for gauging market direction.

He advises traders to avoid aggressive long positions until a close above 24,450 is confirmed. A buy-on-dips strategy may be considered near 24,200, provided tight stop-losses are maintained.

Prabhat Mittal's analysis for the day highlights a cautious yet structured approach to the markets. He sees Nifty support at 24,180 and resistance at 24,420.

Meanwhile, for Bank Nifty, he pegs support at 54,600 and resistance at 55,400.

Asian markets and U.S. equity futures edged higher after China signaled potential trade talks with the U.S. Sentiment was also buoyed by upbeat earnings from some top U.S. tech giants, with Meta leading the charge.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)