Advertisement|Remove ads.

Indian Markets Hit 2025 Highs: Nifty Reclaims 25,200, Smallcaps Rally

Bulls were back on Dalal Street as the Indian equity markets extended gains on Wednesday, ending at their highest level this year. The Nifty reclaimed the 25,200 level after the ceasefire between Iran and Israel came into effect, boosting global sentiment.

The Sensex surged 700 points to close at 82,755, while the Nifty 50 rose 200 points to finish at 25,244. Broader markets outperformed, with the Nifty Midcap index rising 0.4% and Smallcap indices surging 1.5%.

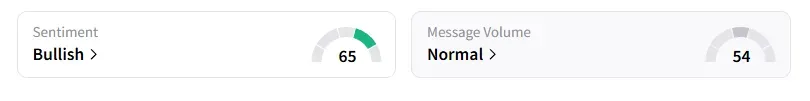

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ on Stocktwits.

Sectorally, all indices ended in the green, led by buying in IT, media, consumer durables, and auto stocks.

MCX ended 5% higher and hit a record high after global brokerage UBS raised its target price to ₹10,000, indicating 21% upside, driven by strong financials and new product launches.

IndiaMART rose 7% on the back of a double upgrade from Nuvama. They have changed their rating to ‘Buy’ from ‘Reduce’ and raised their target price to ₹3,800, indicating a 52% upside.

Dixon Technologies ended 3% lower as brokerage firm Phillip Capital revised its target lower to ₹9,085, implying a 37% downside. They maintained a ‘Sell’ rating, citing increased competition pressures.

Indian Hotels rose 2% as JPMorgan initiated coverage with an "overweight" rating, with a target price of ₹890, implying a potential upside of 17%.

KEC International shares surged over 4% after the company bagged new orders worth ₹1,236 crore for projects in India. Surya Roshni rose 3% and Reliance Infrastructure gained 5% on fresh order wins.

Delhivery ended 3% higher after the logistics company announced the expansion of its Chandigarh Gateway Hub.

Telecom stocks saw strong buying, with Bharti Airtel hitting a fresh record high. Vodafone Idea rose 4%, too.

Meanwhile, defense stocks continued to witness profit booking: GRSE and Data Patterns fell over 5%, while BEL, Mazagaon Dock, Paras Defence, and HAL fell between 2% to 3%.

SEBI-registered analyst Ashish Kyal noted that the underlying sentiment remains bullish, and he eyes a further move towards the Gann level of 25,364.

Globally, European markets traded mixed, and Dow Futures indicated a strong opening for Wall Street. Crude oil prices bounced back after a two-day slump to trade above $65/barrel.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)