Advertisement|Remove ads.

Indian Markets End Higher, Nifty Tops 24,800: Metals, IT Rally As US Court Halts Trump Tariffs

Indian equity benchmarks ended higher on Thursday, driven by global trade relief after a U.S. federal court blocked President Donald Trump’s sweeping “Liberation Day” tariffs, calling them an illegal overreach of executive power.

The ruling, which has been appealed by the Trump administration, temporarily eases trade tensions.

The Sensex ended 320 points higher to close at 81,633, while the Nifty 50 gained 81 points to finish at 24,833 in a choppy monthly expiry session.

The broader markets outperformed, the Nifty Midcap index and the Smallcap index gained 0.6%.

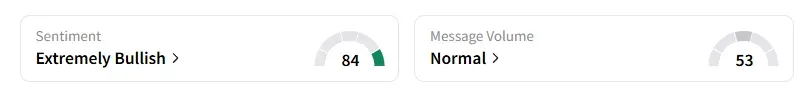

Meanwhile, retail investor sentiment surrounding the Nifty 50 has turned ‘extremely bullish’.

On the sectoral front, metals, IT, and pharma stocks witnessed a relief rally, driven by easing trade concerns after the U.S. court ruling.

MMTC shares surged 20%, hitting an upper circuit, despite weak March-quarter earnings.

Positive management commentary post Q4 earnings drove Samvardhana Motherson (+3%) and Cummins (+7%) higher.

Other earnings gainers include Deepak Nitrite, Mishra Dhatu Nigam, and Deepak Fertilisers, which surged 5% each.

On the other hand, Bharat Rasayan ended 9% lower due to disappointing earnings performance.

Waaree Energies ended 8% higher after its international subsidiary won an order worth $176 million.

Castrol India surged 6% after reports indicated that Reliance Industries and Aramco are in the fray to acquire BP’s lubricant business, which operates under the Castrol brand.

Olectra Greentech extended its losses for the third consecutive session, ending 4% lower.

Vedanta gained 2% after the National Company Law Appellate Tribunal (NCLAT) granted an interim stay on an earlier order by the National Company Law Tribunal (NCLT) that rejected the mining major's demerger scheme.

IndusInd Bank ended over 2% higher despite the market regulator SEBI barring five top executives, including the ex-CEO, in an insider trading case.

Globally, European markets traded higher, and Dow Futures pointed to a strong opening for Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraft_heinz_jpg_4db2a61952.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tom_lee_OG_2_jpg_9ae5c049c3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364715_jpg_59427544e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)