Advertisement|Remove ads.

Indian Markets Soar To 4-Month High, Nifty Ends Above 25,500; FMCG, Real Estate Lead The Charge

Indian equity markets surged to a four-month high, with the Sensex reclaiming the 83,000 mark and the Nifty index closing near 25,600. FMCG, real estate, autos, and consumer durables led the bullish momentum in the markets. PSU banks were the only sector to end in the red, dragged by a select group of weak earnings performers.

On Thursday, the Sensex closed 862 points higher at 83,467, while the Nifty 50 ended up 261 points at 25,585. Broader markets mirrored the optimism, with the Nifty Midcap index rising 0.4% and the Smallcap index gaining 0.2%.

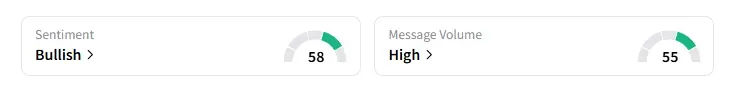

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ by market close on Stocktwits.

Stock Moves

Eternal ended 4% lower on mixed performance in Q2 earnings. Concerns over the food delivery net order value (NOV) weighed on investor sentiment, along with management commentary that they expect a slow uptick in near-term growth. It was the top Nifty loser at close.

Nestle India was the top Nifty gainer, with its shares surging 4% following record domestic sales in Q2. And Axis Bank ended 2% higher on the back of strong loan performance.

RBL Bank ended 2% higher ahead of its board meeting this weekend to mull fund-raising.

KEI Industries ended 6% lower after a key facility at Sanand saw its commissioning get delayed.

New listings, Rubicon ended 30% higher, while Canara Robeco AMC ended 13% higher.

Stock Calls

Analyst Palak Jain flagged a rounding bottom pattern breakout on the weekly chart of Senores Pharma, with the stock clearing a key resistance. Good volumes indicate active accumulation and rising investor interest.

Jain added that this fresh upside setup, confirmed by technicals and supported by a volume surge, is ideal for medium-term swing traders.

She recommended buying above ₹751, with a stop loss at ₹675 for target prices of ₹773, ₹796, and ₹841.

Markets: What Next?

Globally, European markets traded higher, while US stock futures indicate a positive start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)