Advertisement|Remove ads.

Indian Markets Hold Steady; Tech Stocks Rally, IndusInd Dips On Goldman Downgrade

Indian markets opened firm on Wednesday, tracking mixed global cues, as optimism builds around a potential U.S.-India trade deal ahead of the critical July 9 deadline.

At 09:45 a.m. IST, the Nifty 50 traded flat at 25,536, while the Sensex was 16 points higher at 83,713.

Broader markets underperformed, with the Nifty Midcap and Smallcap indices trading flat.

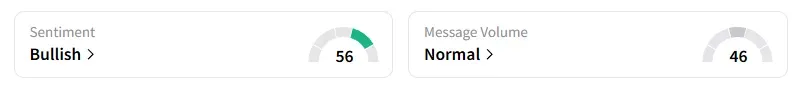

The retail sentiment on Stocktwits for Nifty remained ‘bullish’.

Sectorally, it’s a mixed bag with technology and metals leading the gains, while PSU banks and media stocks witnessed some selling pressure.

IndusInd Bank is the top Nifty loser, falling 3% as Goldman Sachs downgraded it to ‘Sell’ with a target price of ₹722 per share. They expect subdued returns even after a recovery in H2 FY26–FY27, as concerns over a weak yield trajectory and high funding costs persist.

Asian Paints fell 1%. The company is under investigation by the Competition Commission of India (CCI) following a complaint by Birla Opus of abuse of dominance and restrictive distribution clauses.

RITES surged over 5% after securing a $3.6 million deal from an African rail company for overhauled ALCO locomotives. Ceigall India gained 3%, driven by a ₹1,199 crore road project win from the National Highways Authority of India (NHAI).

Prime Focus gained for the third straight session, rising 4% ahead of its board meeting on Thursday to consider raising funds through a preferential issue of equity shares.

Gabriel India rallied another 20% at open, extending gains on its restructuring plans.

MOIL shares rose 2% after it hiked prices of all ferro and chemical grades of manganese ore by 2% from July 1.

RBL Bank gained 1% on reports that Emirates NBD Bank, owned by the Dubai government, is looking to buy a minority stake in the bank.

Dreamfolks shares dropped 3% following the company's announcement to exchanges regarding the closure of specific programs, which is anticipated to have a material impact on its financial performance.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Sameer Pande pegged Nifty support between 25,450 and 25,200, with resistance at 25,800.

A&Y Market Research sees the Nifty intraday resistance between 25,648 and 25,662, and support between 25,308 and 25,322. For Bank Nifty, they peg resistance at 57,633-57,676 and support at 57,028-57,071.

Analyst Varunkumar Patel noted that Foreign Institutional Investors (FIIs) have sold nearly ₹2,000 crores in cash and increased their net short positions in index futures. On Tuesday, the US Senate passed President Trump's "Big, Beautiful Bill" with Vice President JD Vance casting the tie-breaking vote.

He added that global markets are stable and expected to remain so in the coming days. For India, the markets are likely to consolidate until the earnings season begins, which will provide direction. Patel expects select small and mid-cap stocks to outperform. He advised traders to invest in quality stocks with a tight stop-loss.

Globally, Asian markets traded mixed on Wednesday, while crude oil prices held steady ahead of the OPEC meeting to decide August’s output policy.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)