Advertisement|Remove ads.

Micron Stock Hits Record High As Bernstein Sees Biggest Price Upcycle Driving Memory Boom — Retail Calls It ‘Cheap’

- Bernstein raised its price target to $330, flagging accelerating memory price hikes.

- AI-led demand for HBM and DRAM is tightening supply and supporting pricing, Bernstein said.

- Record revenue, expanding margins, and strong cash flow add to the stock’s momentum.

Micron Technology (MU) shares surged to a record high on Friday after Bernstein raised its price target on the memory chipmaker, pointing to what it called the largest pricing upcycle the memory sector has seen.

The stock rose over 7% to $306.02 at the time of writing.

Bernstein Flags Accelerating Memory Price Cycle

Bernstein lifted its price target on Micron to $330 from $270, implying a 15.6% upside to the stock’s previous close. The brokerage said a record price upcycle is now the biggest driver for the memory sector, adding that pricing momentum appears to be running ahead of its existing forecasts, according to a report by Reuters.

“The pace of the price hike may be ahead of our model and accelerate from 4Q25 to 1Q26,” Bernstein said.

AI Demand Tightens Memory Supply

The rally also drew support from Futurum Equities, which said in a post on X that Micron shares were up as high-bandwidth memory (HBM) and high-density Dynamic Random Access Memory (DRAM) have become binding constraints in AI systems.

The firm said every incremental Graphics Processing Unit (GPU), Application Specific Integrated Circuit (ASIC), edge device, and autonomous system requires significantly more memory than current supply assumptions allow.

Record Earnings And Margin Expansion

Micron’s recent first quarter (Q1) results underscored the strength of the cycle. The company reported record revenue and margin expansion across all business units, with its cloud memory business generating more than $5.2 billion in revenue and a profit margin of 66%.

The company’s second-quarter outlook also topped expectations, with revenue guidance of $18.7 billion plus or minus $400 million and adjusted earnings per share of $8.42 plus or minus $0.20, both above consensus estimates compiled by Fiscal AI.

AI Demand Tightens Screws On Memory Supply

Demand for memory used in AI-heavy workloads has continued to climb as cloud infrastructure and generative models scale, lifting interest in Micron’s high-bandwidth and advanced DRAM products that offer higher density and better power efficiency.

To deepen its focus on these faster-growing segments, the company has moved away from its Crucial consumer business, citing rising data-center-led demand and the need to prioritize supply for large, strategic customers.

Micron said the supply-constrained environment is likely to extend beyond 2026, supported by a structural shift in how memory is used across AI systems. The company has guided for further margin expansion in the second quarter, while analysts expect higher DRAM and NOT AND (NAND) prices to persist as tight supply conditions stretch into next year.

How Did Stocktwits Users React?

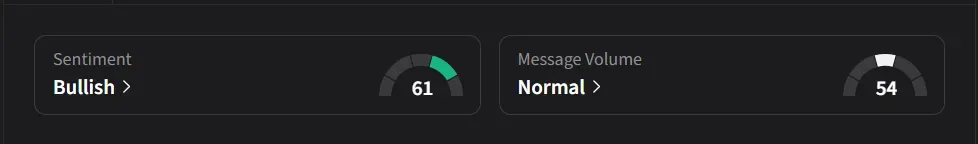

On Stocktwits, retail sentiment for Micron was ‘bullish’ amid ‘normal’ message volume.

One user said the stock could run toward $325–$340 before topping, but warned of a possible pullback to $195–$200 later in 2026.

Another user said the stock is “still not falling. Means it will keep rising. This still seems way too cheap”

Micron’s stock has surged 266% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243840626_jpg_6a78fa8844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)