Advertisement|Remove ads.

Baidu’s AI Chip Spin-Off Strategy Could Ignite 39% Upside In The Stock, Says Jefferies

- Baidu said its AI chip unit, Kunlunxin, submitted an application to the Hong Kong Stock Exchange on January 1, setting the stage for a spin-off and separate debut.

- According to Jefferies’ estimates, Kunlunxin could command a valuation of between $16 billion and $23 billion upon listing independently.

- Based on Baidu’s ownership stake, Jefferies’ analyst believes this translates into roughly $9 billion to $13 billion in attributable value.

Baidu Inc. (BIDU) shares were in the spotlight on Friday after Jefferies lifted its price target on the Chinese technology company, citing value creation tied to a planned separation of its artificial intelligence chip business.

Jefferies analyst Thomas Chong raised his price target on the stock to $181 from $159 while reiterating a ‘Buy’ recommendation, according to TheFly. The price target implies a potential upside of 39% to the stock’s closing price on Wednesday.

Kunlunxin Valuation Impact

Baidu said on Friday that its AI chip unit, Kunlunxin, submitted an application to the Hong Kong Stock Exchange on January 1, setting the stage for a possible spin-off and separate debut. The company added that Kunlunxin would remain under Baidu’s control following any listing.

According to Jefferies’ estimates, Kunlunxin could command a valuation of between $16 billion and $23 billion upon listing independently. Based on Baidu’s 59% ownership stake in Kunlunxin, Chong believes this translates into roughly $9 billion to $13 billion in attributable value for the parent company.

Analyst Thomas Chong stated that the move will not only help clarify Kunlunxin’s market value but also strengthen Baidu’s overall AI business positioning by unlocking hidden value.

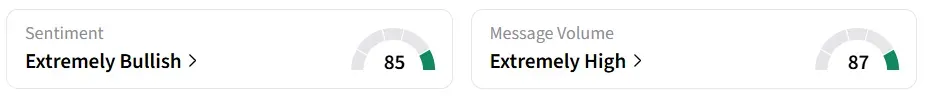

Baidu stock traded over 12% higher by Friday mid-morning. On Stocktwits, retail sentiment around the stock changed to ‘extremely bullish’ from ‘bullish’ territory the previous day amid ‘extremely high’ message volume levels.

Spin-Off Strategy

According to a CNBC report, Baidu’s proposed strategy is aimed at spotlighting Kunlunxin’s individual worth and attracting capital specifically focused on semiconductor innovation. As per the report, Jefferies believes that listing Kunlunxin separately may enhance transparency, broaden investor interest, and allow the unit to access equity and debt markets on its own. Baidu plans to retain majority control of the chip maker after the separation.

According to a Reuters report, the timing reflects a broader effort by China to strengthen its domestic chip industry as U.S. export controls tighten around advanced semiconductor technologies. Several Chinese AI and chip designers have recently moved toward public listings, seeking capital to scale operations and reduce reliance on foreign suppliers.

BIDU stock has gained over 78% in the last 12 months.

Also See: Ondas Eyes 2026 Expansion After Rebranding And Relocation Of Strategic Headquarters

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_altimmune_jpg_8f251e2911.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_ed6fa4554b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)