Advertisement|Remove ads.

Nifty Opens Firm Above 25,250 Ahead Of Expiry; HCL Tech, RBL Bank Among Top Movers

Indian equity markets opened on a positive note, with the Nifty index rising above 25,250 in the weekly expiry session. Sectorally, metals, IT, energy and real estate led the recovery in early trade. On the other hand, autos, pharma, and PSU banks saw some selling pressure.

At 09:40 a.m. IST, the Nifty 50 traded 46 points higher at 25,273, while the Sensex was up 29 points at 82,356. Broader markets mirrored the optimism, with the Nifty Midcap index rising 0.3%, and the Smallcap index gaining 0.5%.

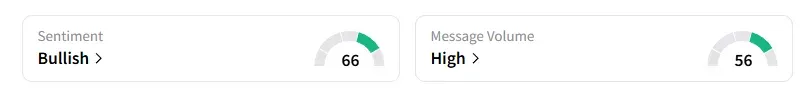

The retail sentiment on Stocktwits for the Nifty was ‘bullish’ at market open amid ‘high’ message volumes.

Stock Watch

HCL Technologies shares gained 2% following a steady show and a hike in guidance in the September quarter (Q2 FY26) earnings. Strong Q2 earnings sparked 4% rally in Anand Rathi, while Just Dial slipped 4% on the back of a mixed performance.

RBL Bank rose 3% on news reports that Emirates NBD is in talks to acquire a controlling stake.

KEC International rose 2% on securing new Transmission & Distribution (T&D) orders worth ₹1,174 crore. Paras Defence gained over 2% on signing a memorandum of understanding with an Israel-based company to develop inertial sensors & closed-loop FOG-based solutions.

Tata Motors will be in focus as it begins trade ex-CV business today. The price of the ex-CV entity will be determined by the difference between the closing price of Tata Motors on Monday and the opening price of the listed entity, as determined during the special pre-open session held between 9 and 10 am.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Tuesday with a 1-week timeframe:

Torrent Power: Buy at ₹1,283, with a target price of ₹1,360, and stop loss at ₹1,245

Lodha: Buy at ₹1,154, with target price of ₹1,175, and stop loss at ₹1,145

HCL Tech: Buy at ₹1,494, with a target price of ₹1,560, and stop loss at ₹1,465

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Prabaht Mittal identified Nifty support at 25,090 with resistance at 25,310. For Bank Nifty, he sees support at 56,300 and resistance at 57,000.

Investment advisor Nidhi Saxena of The Trade Bond said that the outlook stays positive with a buy-on-dips approach as long as the Nifty index holds above 25,150 on an hourly closing basis. After a neutral session yesterday, a trending move is anticipated today. Meanwhile, the Bank Nifty index is forming a series of higher highs and higher lows, maintaining a positive outlook with a buy-on-dips approach as long as it holds above 56,300.

Global Cues

Globally, Asian markets traded mixed, while crude oil prices rose as the US and China look to work through the trade deal concerns.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nintendo_switch_2_jpg_bccd766d3b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245602336_jpg_dcf0764466.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_3_jpg_3ea694b5e1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240006388_jpg_320990af67.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)