Advertisement|Remove ads.

Nifty Tops 25,300 As India–US Trade Talks, Fed Rate Cut Hopes Fuel Optimism

Indian equity markets opened on a positive note, with the Nifty index scaling above 25,300 for the first time since July. The Commerce Ministry’s statement that both India and the US want the trade deal on a fast-track route has acted as a sentiment booster.

At 09:40 a.m. IST, the Nifty 50 traded 99 points higher at 25,338, while the Sensex was up 302 points at 82,683. Broader markets mirrored the gains, with the Nifty Midcap index rising 0.3% and the Smallcap index trading 0.6% higher.

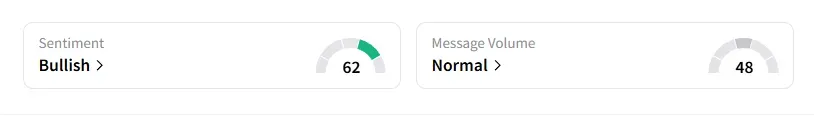

The retail sentiment on Stocktwits for Nifty has remained ‘bullish’ at market open.

Stock Watch

Sectorally, barring minor weakness in metals, all other sectors traded in the green – led by technology, real estate, and autos.

Tata Consumer shares gained over 3% after it rolled out price cuts across many of its tea brands.

Coal India gained over 1% on emerging as the preferred bidder for Ontillu-Chandragiri rare earth exploration block by the Ministry of Mines.

Aditya Birla Fashion shares rose over 3% after the company rebranded its Style Up stores under a new format “OWND” with plans to expand to 100 outlets by the end of this financial year.

Dreamfolks fell 5% after discontinuing its domestic airport lounge services.

Gujarat Fluorochemical fell over 2% following a large block deal. Meanwhile, order wins sparked a 3% rally in Bharat Electronics and over 1% gains for Railtel.

Textiles stocks continued to see strong buying on the back of the renewed trade deal optimism: Gokaldas, Welspun Living, and Kitex rose over 5%.

Varunkumar Patel recommended buying KPR Mills at ₹1,105-₹1,110 for a target price of ₹1,229 and stop loss at ₹1,050 in a 1-month time frame.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Wednesday with a 1-week timeframe:

Tech Mahindra: Buy at ₹1,531 for a target price of ₹1,560, and stop loss at ₹1,515

Cemindia Projects: Buy at ₹825 for a target price of ₹850, and stop loss at ₹815

BEL: Buy at ₹402 for a target price of ₹408, and stop loss at ₹398

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Prabhat Mittal pegged Nifty support at 25,150, with resistance at 25,550. For Bank Nifty, he sees support at 54,900 and resistance at 55,700.

A&Y Market Research pegged the intraday Nifty resistance at 25,308 - 25,322, with support at 25,215 - 25,246. For Bank Nifty (Intraday), resistance is seen at 55,055 - 55,168, with support at 54,492 - 54,587.

Varunkumar Patel noted that foreign investors turned net buyers with ₹300 crore in cash. In derivatives, they covered a good chunk of their index shorts and index call shorts, which shows a shift from defensive to slightly bullish positioning.

He said that the Put-Call Ratio (PCR) at 1.30 indicates a highly overbought market, suggesting traders are aggressively building long positions via puts, which often leads to short-term consolidation or minor pullbacks. Hence, while the undertone is bullish, Patel expects the market to trade in a narrower band today as positions get adjusted.

With major concerns like global slowdown fears, India–US trade tensions, and the rate cycle slowly turning positive, the medium-term setup is constructive. Patel recommended using every dip to accumulate quality stocks, but maintain strict risk management given the near-term overbought condition.

Global Cues

Globally, Asian markets traded mixed, while crude oil prices held steady. Investors will be watching for the US Federal Reserve’s rate decision due tonight, with the markets pricing in a 25 bps rate cut. And any dovish guidance could act as a fresh trigger for global equities, including India, to rally further.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)