Advertisement|Remove ads.

Lucid’s Moment Of Truth: Luxury EV Hype Meets A Brutal Market — Is The Low-Price Pivot Enough?

- Management shake-ups, fresh capital raises, and partnerships—including the Uber robotaxi deal—signal urgency, but investors remain in “show-me” mode until execution improves.

- The planned launch of lower-priced midsize EVs in 2026 is central to Lucid’s turnaround thesis, with analysts betting growth hinges on scaling volumes beyond its luxury niche.

- Retail traders also remain on the sidelines amid the company’s checkered performance this year.

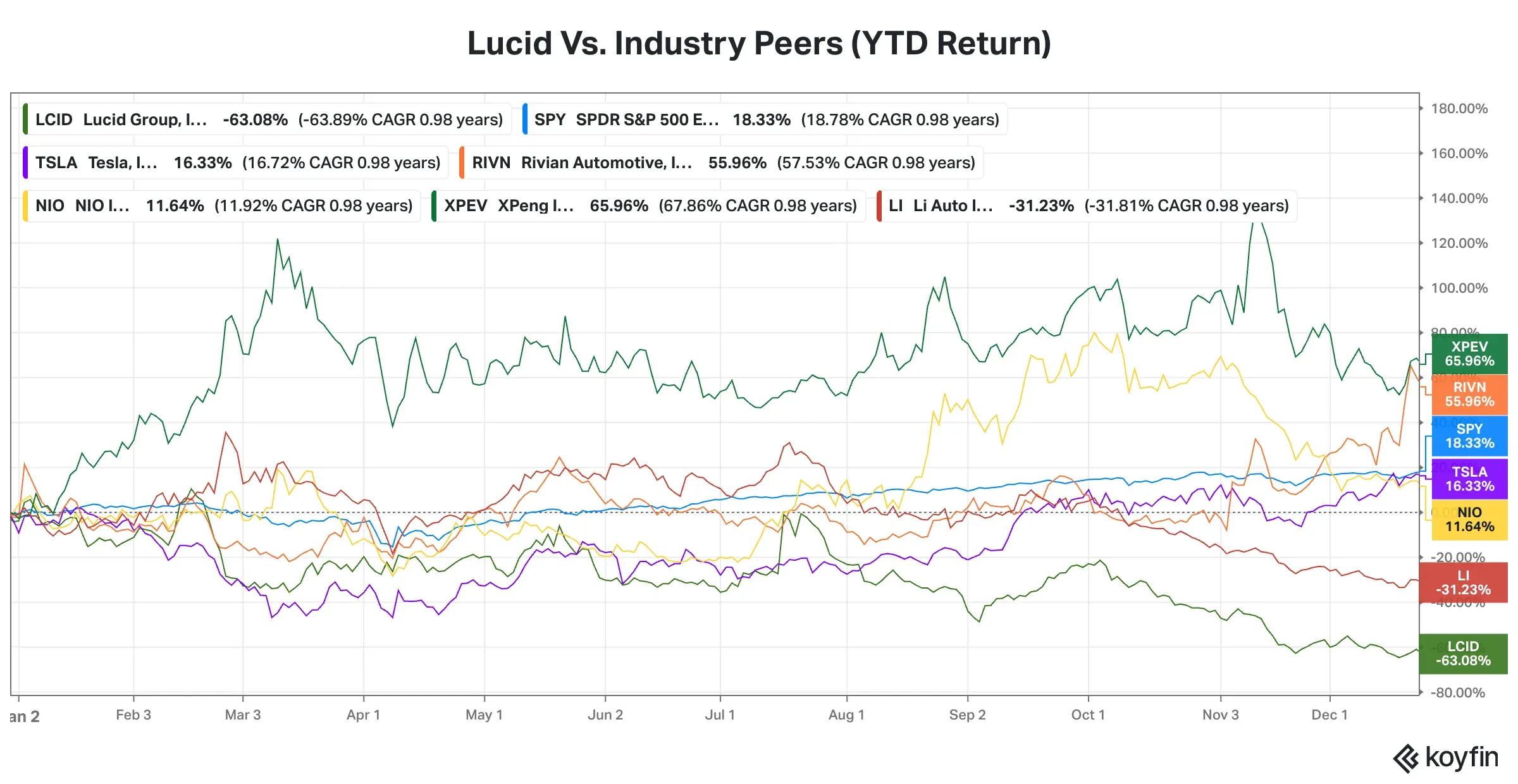

Luxury electric-vehicle (EV) maker Lucid Group, Inc.’s (LCID) stock has been drained of charge this year. Even as the broader market and peers, including startups, took flight, Lucid’s stock was stuck in reverse gear. Shaky industry fundamentals continued to haunt the companies in the space, but their shares weathered the downturn and generated positive returns for investors.

What went wrong with Lucid? And how is it positioned for the near term? Most Wall Street firms covering the stock remain on the sidelines. Lucid has become more of a “Show-me” stock as investors and analysts alike seek execution before they can turn more constructive.

Of the 10 analysts covering the stock, seven remain on the sidelines, and two are ‘bearish, while one has a ‘Buy’ rating, according to Koyfin. Nevertheless, the analyst remains optimistic about a resurgence. The average analyst price target for the stock is $18.06, implying over 50% upside from Wednesday’s close.

Lucid’s Torrid Stock Run

Year-to-date (YTD), Lucid’s shares have fallen 63%, trading below the flat line for most of the year. The SPDR S&P 500 ETF (SPY), a measure of broader market performance, has gained more than 18% during the same period after ending the previous session at a fresh peak.

Source: Koyfin

Source: Koyfin

Shares of EV leader Tesla, Inc. (TSLA), which had its fair share of fundamental woes, came back from behind to turn in a strong second-half performance, thanks to optimism around the robotaxi launch. Fellow startup Rivian Automotive, Inc. (RIVN), which recently wowed with its Autonomy Day announcements, has also seen substantial gains. Meanwhile, the winner among all is XPeng, Inc. (XPEV), a nimble Chinese startup.

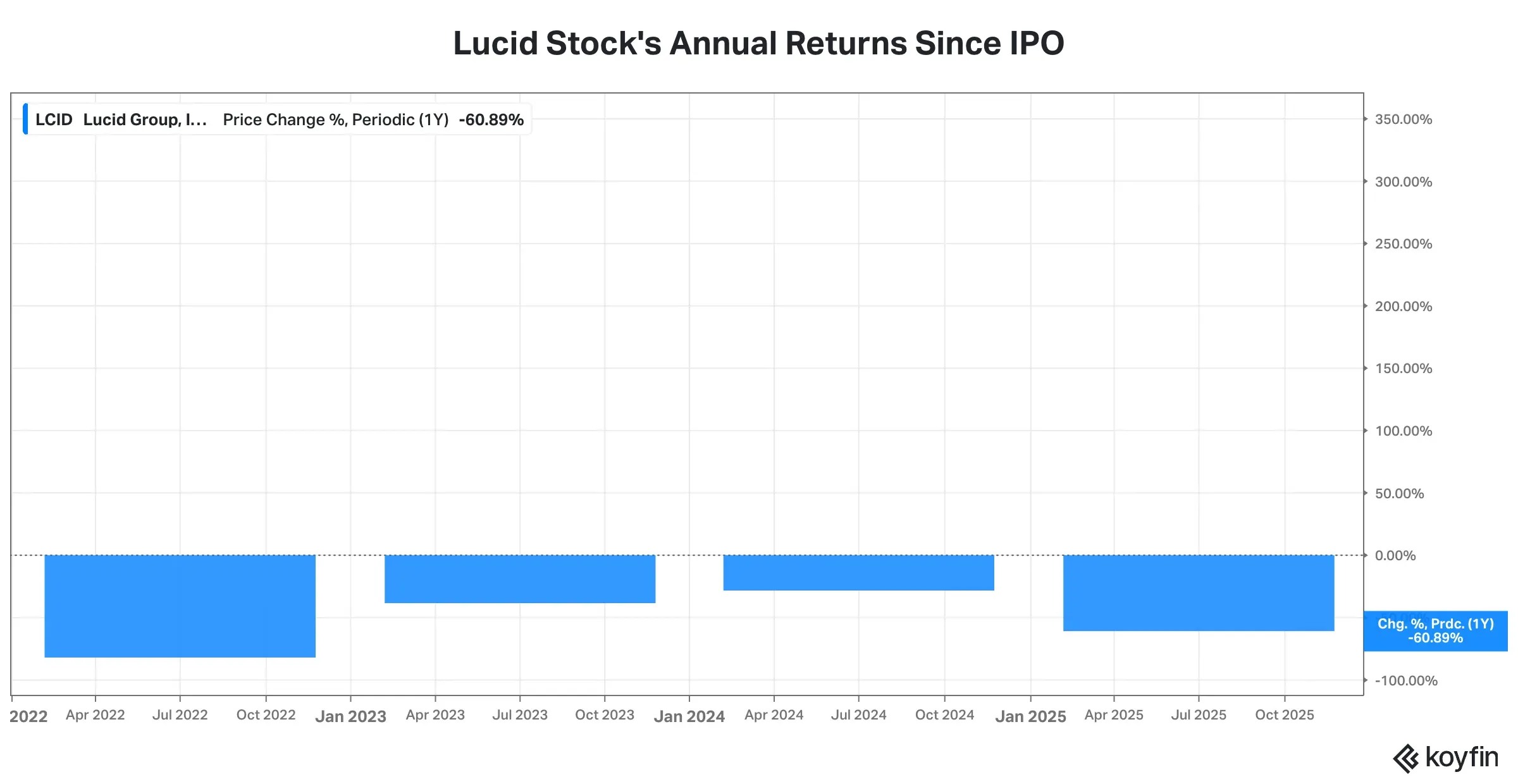

More importantly, Lucid has generated negative returns in all the years that followed its public debut through a Special Purpose Acquisition Company (SPAC) merger with Churchill Capital Corp IV in July 2021.

Source: Koyfin

Lucid’s Flailing Fundamentals

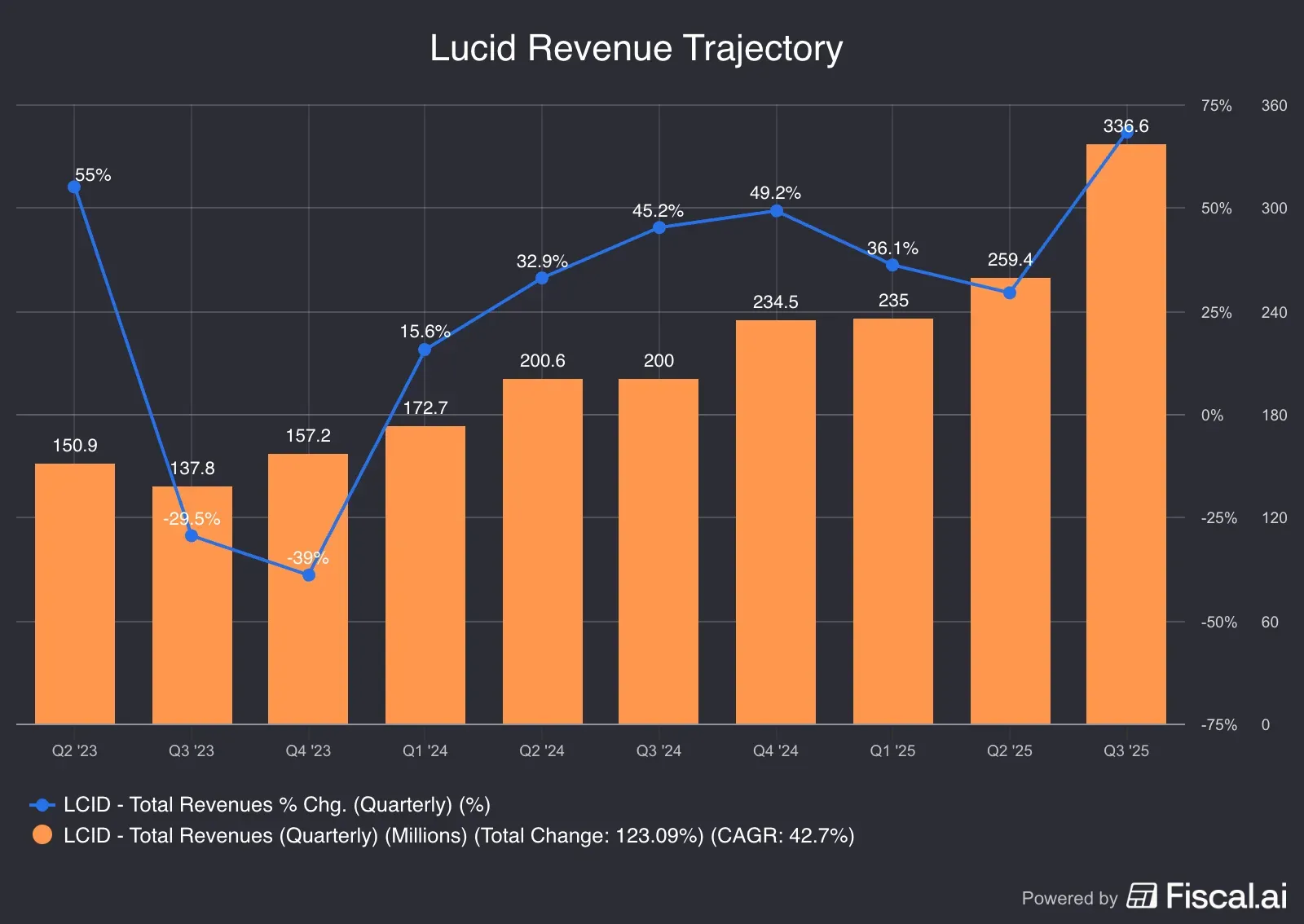

Newark, California–based Lucid has struggled to grow revenue since transitioning to a commercial-stage automaker, hampered by production-scale challenges despite backing from Saudi Arabia’s deep-pocketed Public Investment Fund (PIF).

Source: Fiscal.ai

The lacklustre topline growth is also due to weak deliveries, as the company’s pricier EVs failed to gain traction with price-conscious consumers. According to Spark Co, the average selling price (ASP) of Lucid EV is estimated at $145,000 in 2025. This compares to the $55,000 ASP for EVs in the U.S., according to Recharged.

Source: Fiscal.ai

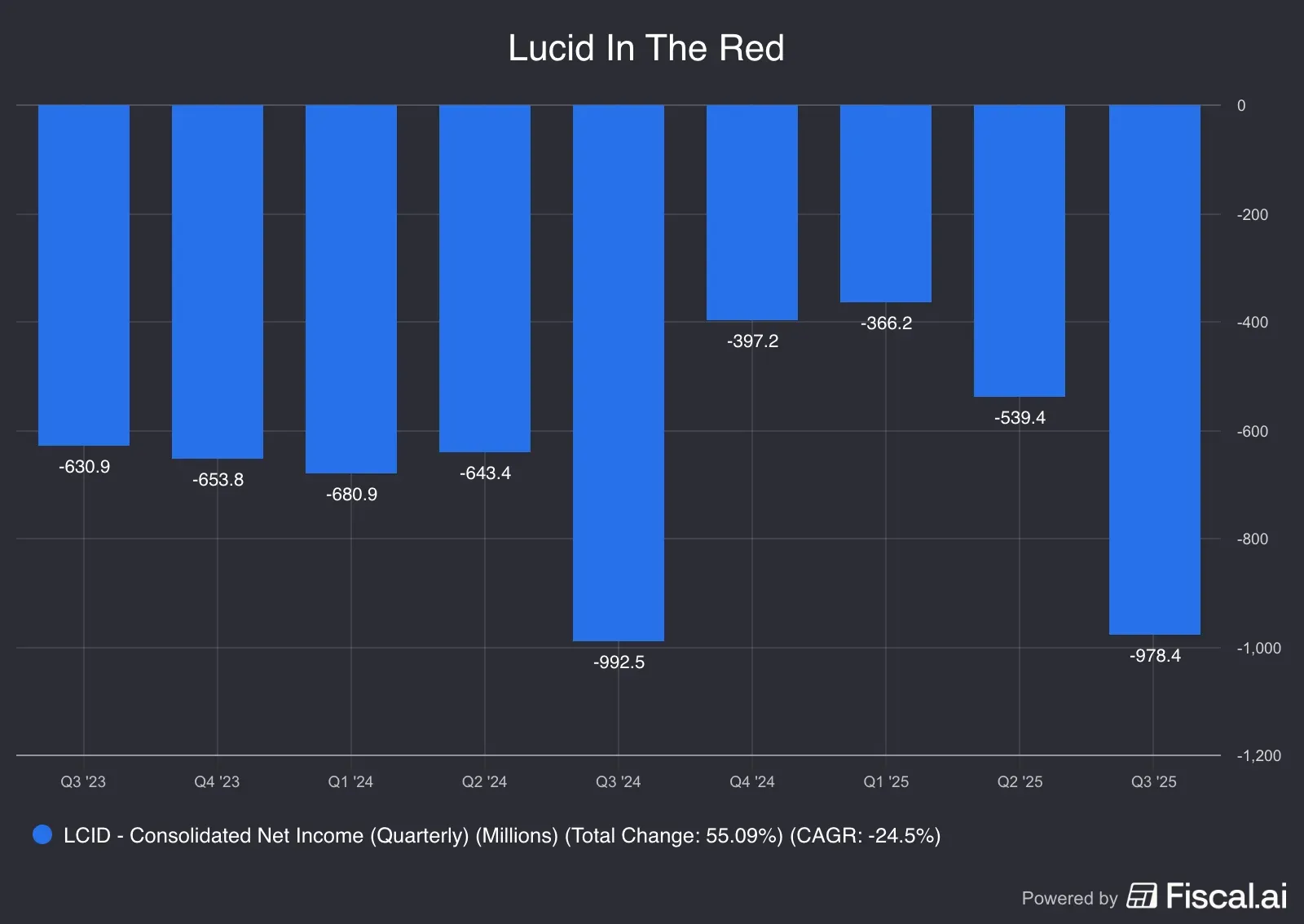

The company is yet to turn a profit, stung by higher input costs and other overheads.

Source: Fiscal.ai

Lucid’s Resuscitation Efforts

As Lucid’s fundamental fortunes hung in the balance, it effected a series of management changes, including the appointment of Taoufiq Boussaid as CFO in February. Gagan Dhingra had held the post on an interim basis since late 2023, when the then CFO, Sherry House, resigned. In the same month, the company announced that Peter Rawlinson would step down as CEO and be replaced by insider Marc Winterhoff on an interim basis. In early November, the company announced more key organizational changes to accelerate growth.

Lucid was quick to raise financing during the year. It completed a $1.1 billion convertible senior note offering in April. Subsequently, the company raised $962 million through a private offering of convertible senior notes. It also received a $500 million investment from Uber, announced as part of a robotaxi collaboration. The three-way partnership among Lucid, Nuro and Uber for a next-generation robotaxi program that envisages deploying 20,000 or more Lucid vehicles over six years in dozens of markets worldwide. The first launch in a major city is planned for 2026.

On the product front, the company launched its Gravity SUV in two variants, Touring and Grand Touring, with starting prices of $79,900 and $94,900, respectively.

As its stock price teetered, Lucid implemented a 1-for-10 reverse stock split that took effect in late April.

What Retail Feels About Lucid

Retail investors remain skeptical about Lucid’s path forward. On Stocktwits, users held a ‘neutral’ sentiment toward Lucid stock as of early Friday. The mood toward the stock has remained lackluster throughout the year.

Road Ahead For Lucid

Lucid’s next wave of lower-cost EVs will likely help the company vindicate itself, according to a S&P Global report, which cited analysts. The company plans to launch its first midsize EVs in 2026, which it categorizes as “Future Vehicles.”

Citing Visible Alpha consensus estimates, the firm said Future Vehicles’ ASP will be at $58,040 in 2027 compared to $73,371 for Air and $88,519 for Gravity. Analysts expect unit sales of 18,750 for Future Vehicles in 2027, generating $1.1 billion in revenue. S&P Global is also optimistic about the near term:

“Lucid’s overall revenue is projected to climb 60% year-on-year to $1.3 billion in 2025. Air remains the backbone with $920 million in expected sales, while Gravity—launched late last year—is forecast to scale quickly, with revenue jumping from $13 million in 2024 to $316 million in 2025.”

In premarket trading, Lucid’s stock was down over 0.50% at $11.73.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Does Nvidia’s Groq Licensing Mega-Deal Expose A Quiet Weak Spot In Its AI Chip Empire?

/filters:format(webp)https://news.stocktwits-cdn.com/large_blue_owl_capital_jpg_4d9954c2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553061_jpg_699278f844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trump_media_and_technology_group_media_009b60f8cd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HP_corporate_logo_resized_a2479d3136.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_terawulf_OG_jpg_a87a18705d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)