Advertisement|Remove ads.

Weak Start On Dalal Street As TCS Earnings Miss Drags IT Stocks; Tesla Entry Rattles Auto, But Glenmark, HUL Buck The Trend

Indian equity markets opened weak on Friday, with the Nifty index hovering around 25,300 as weak earnings from TCS dragged the IT sector lower.

At 09:50 a.m. IST, the Nifty 50 traded 53 points lower at 25,302, while the Sensex was down 221 points at 82,969. Broader markets also traded under pressure with the Nifty Midcap and Smallcap indices falling 0.2%.

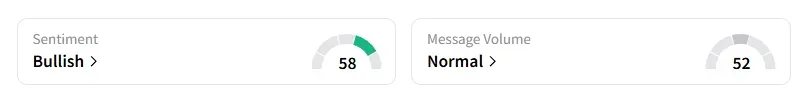

However, the retail sentiment on Stocktwits for Nifty remained ‘bullish’.

Sectorally, technology and media indices were the biggest laggards, followed by auto, oil & gas, and consumer durables. Meanwhile, FMCG, healthcare, and pharmaceuticals witnessed strong buying.

Glenmark Pharmaceuticals surged 10%, driven by the announcement of an exclusive licensing agreement between its innovation arm, IGI, and AbbVie for a cancer treatment drug. Hindustan Unilever was the top Nifty gainer, rising 4% after the company appointed Priya Nair as MD & CEO for a five-year term starting August 1, 2025, succeeding Rohit Jawa.

Tata Consultancy Services (TCS) fell 2% after its first-quarter earnings missed estimates with a larger-than-expected constant currency revenue drop. Brokerages such as Nomura and UBS have revised their target prices lower. This weighed on the rest of the IT sector as well, with Infosys, Wipro, LTIMindtree, and HCL Tech falling between 1% to 2%.

Tata Elxsi fell 4% on disappointing first-quarter results. Brokerage firm Bernstein maintained an ‘Underperform’ rating with a target price of 4130, indicating 33% downside. Weak show in Q1 also dragged Indian Renewable Energy Dev Agency (IREDA) shares over 4%. Meanwhile, Anand Rathi rose 4%, driven by strong earnings as it reported its 14th quarter of 20%+ profit growth.

Zee Entertainment fell 3% after its shareholders rejected the proposal to raise ₹2,237.44 crore from promoter entities.

Auto stocks trended lower after electric vehicle maker Tesla said it would be opening its first showroom in Mumbai on July 15, according to reports.

Watch out for Avenue Supermarts (DMart), Aditya Birla Money, and Elecon Engineering, among others, as they report quarterly earnings today.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Prabhat Mittal pegged Nifty support at 25,100 and resistance at 25,420. For the Bank Nifty, he sees support at 56,200 and resistance at 57,100.

A&Y Market Research sees Nifty intraday resistance between 25,648-25,662, with support at 25,308-25,322. For Bank Nifty, they pegged intraday resistance at 57,028-57,071, and support at 56,467-56,510.

Analyst Varunkumar Patel highlighted that Foreign Institutional Investors (FIIs) have purchased over ₹220 crore in cash market stocks, while maintaining a net short position in index futures within the F&O segment. He added that Nifty could test 25,200 and a failure to hold this level could trigger a significant correction on Friday and next few sessions.

Financial Independence identified Nifty support at 25,125-25,000 and resistance at 25,425-25,550. For Bank Nifty, support is seen at 56,600-56,300, and resistance between 57,200-57,500.

Globally, Asian markets traded largely positive despite US President Donald Trump announcing 35% tariffs on Canada and threatens 15–20% on other partners, amplifying global trade uncertainty.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)