Advertisement|Remove ads.

Cautious Start For Dalal Street As India Lags On US Trade Pact; Kotak Bank Tanks 6%

Indian equity markets opened lower on Monday, with the Nifty index hovering below the 24,800 level. The U.S. has signed a trade deal with the EU, and talks with China may lead to a 90-day extension of their tariff truce, according to reports. However, India’s delay in sealing a trade deal with the U.S. ahead of the August 1 deadline might weigh on sentiment.

At 09:45 a.m. IST, the Nifty 50 traded 46 points lower at 24,790, while the Sensex was down 196 points at 81,266. Broader markets outperformed, with the Nifty Midcap index rising 0.3% and the Smallcap index gaining 0.1%.

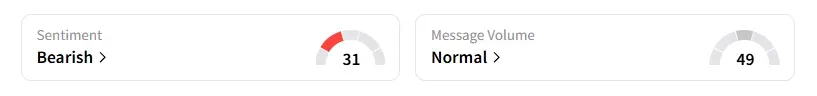

Meanwhile, the retail sentiment on Stocktwits for Nifty continued to remain ‘bearish’.

Sectorally, real estate (-2.5%), private banks (-1%), and technology (-0.8%) indices took a knock. On the other hand, pharma, FMCG, and energy indices saw some buying action.

Kotak Mahindra Bank was the top Nifty loser, falling over 6% on weaker-than-expected Q1 earnings. Followed by TCS, which fell over 1% after the company announced its plans to reduce its workforce by 2% over FY26.

Other earnings movers include SBI Cards and CDSL (-3%), while Aadhar Housing Finance surged 7%, and Tata Chemicals, Petronet LNG, Shriram Finance rose 2% as the street parsed its June quarter earnings.

Wockhardt surged 5% after a UK Medical Journal Publication detailed the successful use of its drug Zaynich in a complex case.

Watch out for IndusInd Bank, Bharat Electronics, Adani Green Energy, Adani Total Gas, Bajaj Healthcare, CarTrade Tech, Gail (India), JK Paper, KEC International, Mazagon Dock Shipbuilders, among others, as they report quarterly earnings today.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Ashish Kyal noted that if the Nifty index manages to give a close above 24,920 on the 15-minute timeframe, we could see a short-term positive move to 24,980-25,020 levels, but any break below 24,790 will continue the downtrend to Gann levels of 24,728. He advised traders to continue scalping trades unless a clear pattern emerges.

Prabhat Mittal has identified Nifty support at 24,500 and resistance at 25,020. For the Bank Nifty, he sees support at 56,000 and resistance at 56,900.

Varunkumar Patel noted that Foreign Institutional Investors (FIIs) sold around ₹2,000 crore in the cash segment. In the F&O space, they’ve added net short positions in both Nifty and Bank Nifty, showing growing caution. With global event risk and macro uncertainty building into August, they expect higher volatility. Additionally, a lack of strong earnings drivers could continue to put pressure on the markets. Patel advised traders to remain cautious and focus on quality names with solid fundamentals.

A&Y Market Research identified intraday Nifty resistance between 25,308 and 25,322, and support at 25,009-25,075. For Bank Nifty, they peg resistance at 56,588 - 56,632 and support at 56,206-56,278.

Globally, Asian markets traded mixed, while crude oil prices rose from three-week lows after the U.S. and European Union reached a trade agreement that eased tariff concerns.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)