Advertisement|Remove ads.

Nifty Slips Below 25,200 Ahead Of Expiry; Tech Mahindra Drops On Q1 Miss, SBI Rises On Fundraise

Indian equity markets opened on a subdued note on Thursday, tracking mixed global cues and weekly expiry session. Investors will be watching for developments on an interim US-India trade deal after US President Donald Trump hinted at progress in negotiations.

At 09:45 a.m. IST, the Nifty 50 traded 22 points lower at 25,189, while the Sensex was down 64 points at 82,570. Broader markets were mixed, with the Nifty Midcap index falling 0.1% and the Smallcap index trading flat with a positive bias.

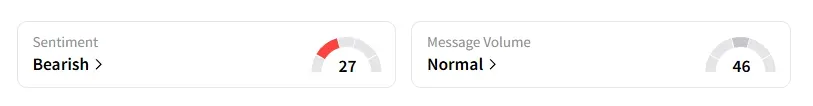

Meanwhile, the retail sentiment on Stocktwits for Nifty moved from ‘extremely bearish’ to ‘bearish’ after markets opened.

Sectorally, IT, media, and banking are under some pressure, while pharma, metals, and real estate saw buying activity.

SBI shares rose over 1% after the largest lender in India launched a QIP to raise up to ₹25,000 crore through a share sale to institutional investors. The floor price has been set at ₹811.05 per share.

Tech Mahindra fell over 1% after its first-quarter earnings failed to impress the street.

On the other hand, Angel One rose 2%, while Le Travenues Technology (Ixigo) surged 10% on earnings cheer.

Emcure Pharmaceuticals gained nearly 1% as the company signed an exclusive distribution agreement with Sanofi India for oral anti-diabetic drugs, including Amaryl and Cetapin, in India.

Watch out for Axis Bank, Wipro, Jio Financial, LTIMindtree, Indian Hotels, Tata Communications, Waaree Renewables, among others, as they report quarterly earnings today.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Ashish Kyal noted that if the Nifty index breaks above 25,260, it will continue an uptrend to 25,361 Gann levels, with support on the downside near 25,120. Overall tone remains on the buy side unless it closes below the previous low. Kyal suggested that a bull call spread strategy would be effective, as implied volatility remains low and momentum has yet to pick up.

Analyst Varunkumar Patel highlighted that Foreign Institutional Investors (FIIs) have offloaded over ₹1,800 crore in cash market stocks while building fresh net short positions in index futures and options (F&O). Despite a stable to positive global sentiment, the potential impact of Trump tariffs looms. Indian markets appear resilient to FII selling, but a breakout above 25,350 seems unlikely unless FII sentiment turns bullish, according to Patel.

With Thursday being the weekly Nifty expiry, expect significant volatility. His strategy has shifted to aggressive bets on stocks with strong results, backed by strict stop-losses.

A&Y Market Research identified intraday Nifty resistance between 25,308 - 25,322, and support at 25,009 - 25,075. For Bank Nifty, they peg resistance at 57,633 - 57,676 and support at 57,028 - 57,071.

Globally, Asian markets traded mixed even as US President Donald Trump downplayed speculation that he may soon fire Federal Reserve Chair Jerome Powell.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)