Advertisement|Remove ads.

Indian Markets Open Weak As FII Selling, Earnings, US Trade Deal Concerns Keep Investors On Edge; Bajaj Twins Tumble, IEX Rebounds

Indian equity markets opened weak, tracking mixed global cues, with the Nifty index slipping below the crucial support level of 25,000. Sustained foreign investor selling and subdued earnings so far continue to weigh on sentiment.

Ahead of the August 1 tariff deadline, India’s Commerce and Industry Minister Piyush Goyal remarked that trade deal negotiations with the United States are “progressing extremely well.”

At 09:50 a.m. IST, the Nifty 50 traded 135 points lower at 24,927, while the Sensex was down 406 points at 81,777. Broader markets mirrored the weakness, with the Nifty Midcap index declining 0.2% and the Smallcap index falling 0.4%.

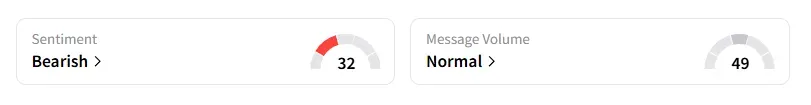

Meanwhile, the retail sentiment on Stocktwits for Nifty remained ‘bearish’.

Sectorally, it’s a mixed bag with financials, auto, and FMCG under pressure. On the other hand, IT, PSU bank,s and real estate saw some gains.

Bajaj Finance fell over 5% after management commentary on asset quality concerns weighed on investor sentiment post its June quarter earnings. JPMorgan has downgraded the stock to ‘Neutral’ from ‘Overweight. Its twin, Bajaj Finserv, also fell 4% ahead of earnings due today. They were the top Nifty losers on Friday.

On the other hand, Indian Energy Exchange (IEX) rebounded 12% after its 30% crash on Thursday. The company reported a 21% rise in profit and a 13% revenue gain amid regulatory overhang.

Other earnings movers include Cyient, Trident, Phoenix Mills, and Anant Raj, who have gained over 5% on a steady show in Q1. In contrast, KFin Technologies fell 7%.

Authum Investment shares fell 10% following a large block deal.

Enviro Infrastructure rose 2% on securing an ₹221.3 crore EPC order

Watch out for Shriram Finance, Bajaj Finserv, Cipla, Bank of Baroda, Laurus Labs, Paras Defence, SAIL, SBI Cards, and Tata Chemicals, among others, as they report quarterly earnings today.

Additionally, Kotak Mahindra Bank, Lodha Developers, IDFC First Bank, and Whirlpool are scheduled to report earnings on Saturday.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Varunkumar Patel noted that Foreign Institutional Investors (FIIs) have sold over ₹2,000 crore worth of equities in the cash market. In the derivatives segment, they’ve made negligible reductions to their net index short positions, indicating no significant shift in sentiment yet. He added that, ahead of the August 1 US tariff deal deadline, the market is likely to become nervous and may see increased volatility over the next 1–2 weeks due to global triggers and political noise. Patel advised traders to remain cautious, stick to fundamentally strong stocks with tight stop-losses.

A&Y Market Research identified intraday Nifty resistance between 25,308 - 25,322, and support at 25,009 - 25,075. For Bank Nifty, they peg resistance at 57,213 - 57,317 and support at 57,028 - 57,071.

Globally, Asian markets traded broadly lower, while crude oil prices rose marginally on optimism surrounding trade deals and reports that Russia was considering curbing gasoline exports.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_540185275_jpg_21d1350875.webp)