Advertisement|Remove ads.

Nike Retail Investors Turn More Bullish As Q1 Performance Confirms Turnaround Progress: 'Good Report In Difficult Market'

Nike shares jumped 4.5% in after-hours trading on Tuesday, with retail investors turning markedly upbeat after the sportswear giant posted strong quarterly results that reinforced confidence in its recovery.

Nike reported a surprise 1% rise in its first-quarter revenue to $11.72 billion, driven by improving trends in North America, the company's largest market, where sales increased 4%. Higher sales in its running portfolio also bolstered the top line. Analysts were expecting a 5.1% revenue decline for the quarter.

Earnings per share of $0.49 also beat expectations, coming in nearly twice the expected $0.27.

"Nike's journey back to greatness has only just begun," CEO Elliott Hill, who is at the forefront of a turnaround effort since he took over the role last October, said in the analyst call on Tuesday.

"We're in the early stages and our comeback will take time, and our progress won't be linear, especially in the areas such as Sportswear, NIKE Direct, Greater China and Converse," he added, according to the call transcript on Koyfin.

While the quarterly performance impressed, the outlook was mixed. Nike projected continued weakness in China—where sales slid 9% in the recent quarter—and steeper-than-anticipated tariff pressures. The company now forecasts tariff costs of $1.5 billion for the fiscal year, up from the $1 billion it projected just three months earlier.

Nike forecast second-quarter revenue to fall in the low single digits, compared with estimates of a 3.1% drop.

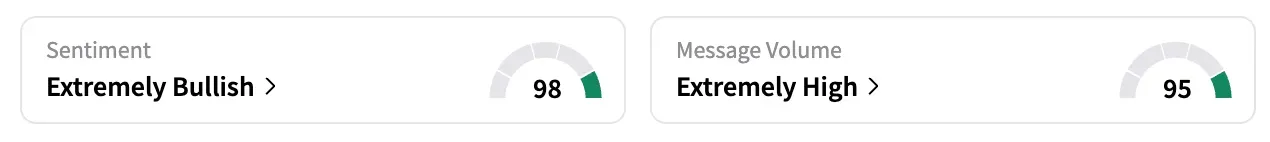

On Stocktwits, the retail sentiment climbed multiple notches to 'extremely bullish' (98/100). The stock was among the top-trending tickers on the platform, as 24-hour message volume rose by over 1,000%.

"$NKE good report in difficult market for Nike.. $80 incoming," a user said, with some even projecting the stock hitting $100 in the coming days.

As of the last close, NKE stock is down nearly 8% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Chevron_resized_1_jpg_1b1a0706af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219534970_jpg_26309c3443.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2242292649_jpg_631e331f1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stryker_resized_jpg_a7934d3fa1.webp)