Advertisement|Remove ads.

Nike Shares Are Rising Premarket: Here's Why

Nike shares rose over 2% in early premarket trading on Thursday, after an analyst upgraded the sportswear giant’s stock.

RBC Capital Markets raised its rating on Nike shares to 'Outperform' from 'Sector Perform, in line with Wall Street's majority view, and price target to $90 from $76.

Currently, 21 of the 39 analysts covering the stock have a 'Buy' or higher rating, 16 rate the stock 'Hold,' and one each rates it 'Sell' and 'Strong Sell,' according to Koyfin's data. Their average price target is 79.76, implying an over 10% upside to the stock's last close.

RBC Capital analysts expect a "steeper revenue recovery" for Nike than Wall Street estimates reflect, with new product contribution and momentum around the FIFA World Cup in the United States, Canada, and Mexico next year, according to the investor note summary on The Fly.

The company is "taking the right steps," with particular improvements in the running footwear, raising prospects of a quarterly earnings beat and guidance raise cycle, with limited share downside, according to RBC.

Over the years, Nike has lost ground amid increasing competition and the emergence of newer sportswear brands such as Lululemon, Under Armour, and Deckers.

The company brought back veteran Elliott Hill from retirement to take over as CEO in October last year. He has since implemented sweeping changes, including layoffs, management restructuring and new product development with a particular focus on Nike's core categories like running and basketball.

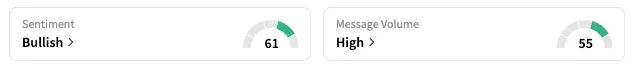

On Stocktwits, retail sentiment toward NKE was ‘bullish,’ even as the stock remains down 4.4% for the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Why Is Opendoor Stock Rising Over 3% Premarket Today?

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229273911_jpg_6b4851e2cc.webp)