Advertisement|Remove ads.

Nike Stock Rises After Hours As CEO Elliott Hill Joins Tim Cook in Insider Buying

- The filing shows an open-market insider purchase after the latest earnings report.

- The buys come as Nike works through a multi-year turnaround with mixed regional trends.

- Retail attention picked up as investors look toward 2026 catalysts.

Shares of Nike (NKE) rose nearly 2% in after-hours trading on Tuesday after a regulatory filing showed chief executive Elliott Hill made an open-market purchase of the company’s stock, adding to a recent insider buy by board member Tim Cook.

CEO Purchase

According to an SEC Form 4 filed on Tuesday, Hill bought 16,388 shares of Nike Class B common stock on Dec. 29 at a weighted average price of about $61.10 per share, for a total value of roughly $1 million.

Following the transaction, Hill directly owned 241,587 shares, the filing showed.

Cook Adds $3M Bet

Hill’s buy follows a separate insider transaction disclosed last week showing Tim Cook, a long-tenured Nike board member, purchased 50,000 shares at a weighted average price of $58.97, investing about $2.95 million.

Cook is Nike’s lead independent director and chairs its compensation committee. He has served on the board since 2005 and has been closely involved in major decisions, including leadership transitions and technology partnerships.

Strong Quarter Amid Cautious Holiday Outlook

The insider buying came after Nike posted quarterly earnings that topped Wall Street expectations, but warned of low single-digit revenue declines on a constant-currency basis for the holiday quarter.

Nike said U.S. tariffs were continuing to pressure costs, with $1.5 billion in annualized incremental product costs, weighing on margins for the latest quarter.

Turnaround Effort

Hill, who returned from retirement to lead Nike, has said the company is in the “middle innings” of its turnaround. North America has begun to stabilize, helped by renewed wholesale partnerships and cleaner inventory levels, while China remains a pressure point amid weaker demand and intensifying competition.

Nike has been working to rebuild wholesale relationships after an earlier push toward direct-to-consumer sales, while accelerating product launches in running and performance categories to regain market share.

How Did Stocktwits Users React?

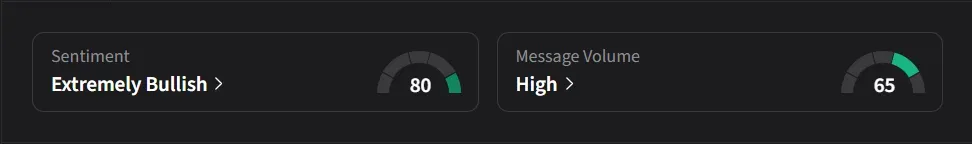

On Stocktwits, retail sentiment for Nike was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “2X coming in 2026. Lots of catalysts.”

Another user said insider buying by Nike’s CEO and Apple’s Tim Cook is mounting pressure on short sellers.

Nike’s stock has declined 17% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tesla_cybertruck_resized_7ce9ec6562.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_stock_jpg_770e12377f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206312585_jpg_1a7c050dff.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205716060_jpg_b54d4e2d13.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)