Advertisement|Remove ads.

Nike Turnaround Faces A Longer Road Despite Brand Strength, UBS Says

- UBS reiterated its Neutral stance on Nike, citing strong brand equity but a prolonged recovery timeline.

- It believes Nike’s brand strength should support a long-term recovery.

Shares of Nike (NKE) were in the spotlight on Friday after UBS analyst Jay Sole said Nike’s brand remains strong, which will help the sportswear firm turn around its ongoing struggles; however, the turnaround will take longer than the market expects.

As per TheFly, UBS said in a note that it continues to believe Nike's business will improve. It rated the stock as “Neutral,” saying that the rating reflects the view that the company's turnaround will take longer than the market expects. UBS maintained a $62 price target on Nike shares.

Turbulent Few Years

Nike has seen leadership changes, management resets, excess inventory, and renewed focus on innovation, leading to a slow, uneven turnaround under scrutiny.

Nike has worked to clean up excess inventory, particularly by reducing production of legacy franchises such as Air Jordans and Air Force 1s. While the reset pressured near-term results, the company said in December that inventory levels are now healthy across North America, EMEA, and other key regions.

Struggles In China

The struggle in China has been longstanding for Nike, as it is continuing to face steep competition from other retailers. The recent tariff war between the two largest economies has further slowed Nike’s efforts to gain market share in China’s booming outdoor sports market.

Nike, in its recently reported second-quarter results, said its footwear sales in China fell 21%, and overall sales fell 17% to $1.42 billion. The China region accounts for nearly 15% of Nike’s annual revenue.

Tim Cook’s Vote Of Confidence

Apple CEO Tim Cook has, time and again, through strategic shifts, market scepticism, and operational missteps, publicly and privately reinforced his confidence in Nike, lending credibility when the brand needed it most.

Cook has been on Nike’s board since 2005. He recently echoed his long-standing relationship with Nike after it made an open-market purchase of about $3 million worth of the company’s stock, a personal investment.

How Did Stocktwits Users React?

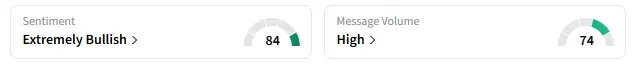

Retail sentiment on NKE trended in ‘extremely bullish’ amid ‘high’ message levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)