Advertisement|Remove ads.

Nio Q1 Earnings Disappoint Investors: Retail Sees Stock Hitting $2

NYSE-listed shares of Chinese EV maker Nio Inc. (NIO) fell 2% on Tuesday morning after the company reported lower-than-expected first-quarter (Q1) revenue and wider-than-expected quarterly loss.

The company’s total revenue came in at RMB12.03 billion ($1.67 billion), representing an increase of 21.5% year-over-year (YoY), but below an analyst estimate of RMB12.46 billion, as per Finchat data.

Adjusted and diluted net loss per share was RMB3.01, compared with a loss of RMB2.39 in the first quarter of 2024, and higher than the expected loss of RMB2.38.

Adjusted net loss attributable to ordinary shareholders of the company rose to RMB6.28 billion, up from RMB4.9 billion in the first quarter of 2024.

Vehicle deliveries were 42,094 in the first quarter of 2025, consisting of 27,313 vehicles from the company’s premium smart electric vehicle brand, NIO, and 14,781 vehicles from its family-oriented ONVO brand, representing an increase of 40.1% from the first quarter of 2024.

The company started delivering its Firefly brand vehicles only in April 2025.

For the second quarter, Nio expects to deliver between 72,000 and 75,000 vehicles, representing a year-on-year growth of 25.5% to 30.7%.

The company expects total revenue in the second quarter to be between RMB19.51 billion and RMB20.07 billion, representing an increase of approximately 11.8% to 15.0% from the same quarter of 2024.

Analysts, meanwhile, expect the company to report a revenue of RMB19.98 billion in the period.

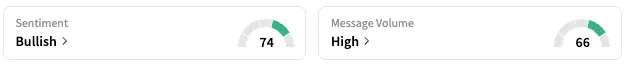

On Stocktwits, retail sentiment around Nio rose from ‘neutral’ to ‘bullish’ territory while message volume rose from ‘normal’ to ‘high’ levels.

A Stocktwits user, however, expects the stock to hit as low as $2.

NIO stock is down by about 24% this year and by about 35% over the past 12 months.

Read Next: GE Aerospace Teams Up With Kratos To Develop Engines For Next-Gen UAVs And CCA-Type Aircraft

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Exchange Rate: 1 RMB= 0.14 USD

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)