Advertisement|Remove ads.

Forget Tesla, Rivian, Lucid: These 2 Chinese Stocks Are 2025's Surprise EV Leaders — And Retail Loves Them

Tesla, Rivian and Lucid may dominate headlines in the U.S. electric vehicle space, but two Chinese players have emerged as the surprise EV stars of 2025, delivering standout returns and catching the eye of retail investors.

While Rivian (RIVN) is up 19% year-to-date, Tesla (TSLA) and Lucid (LCID) have posted losses of about 15% and 12%, respectively.

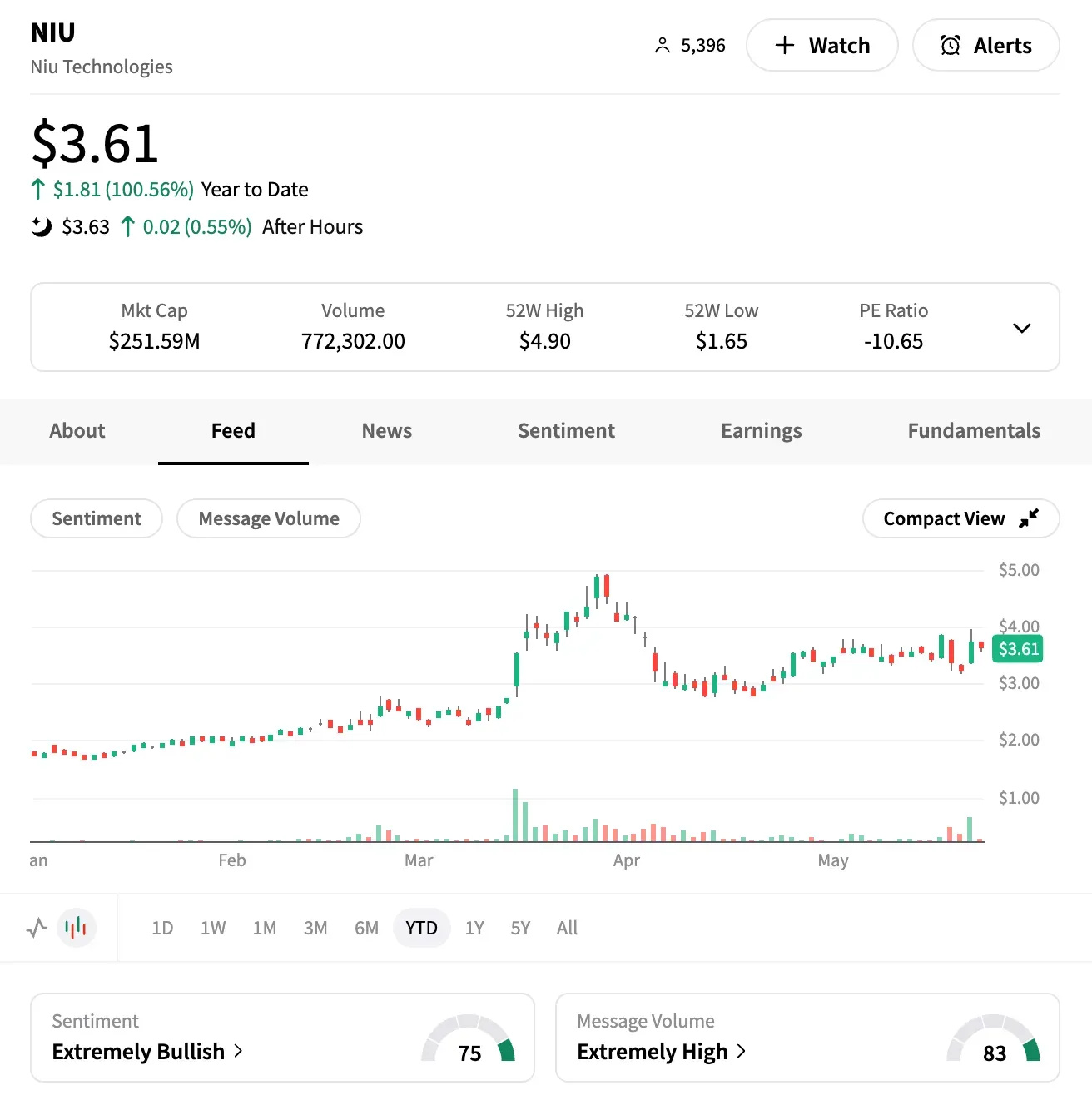

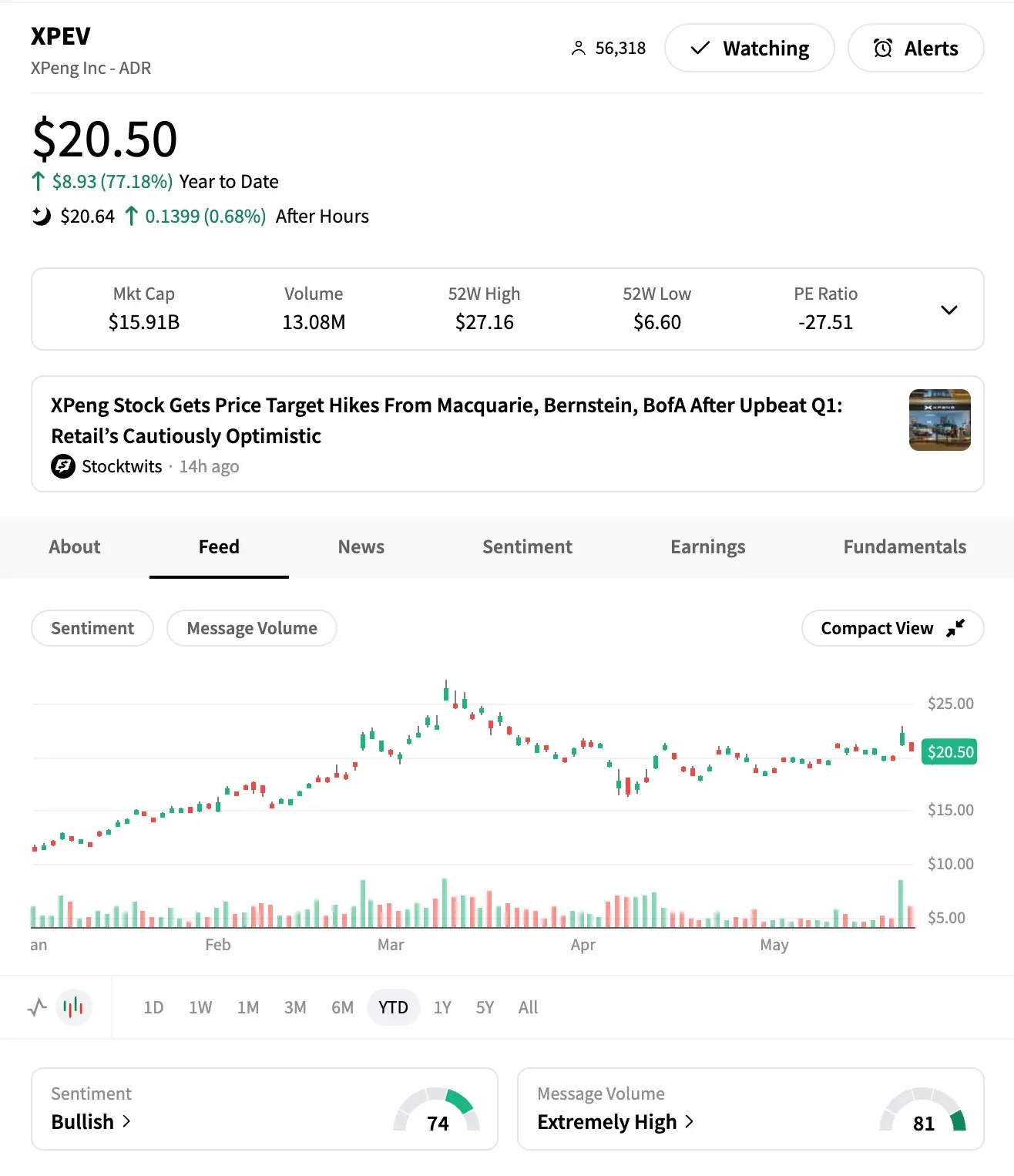

In contrast, Niu Technologies (NIU) has more than doubled, and XPeng Inc. (XPEV) has surged 77%.

The Breakout Players

Beijing-based Niu Technologies specializes in urban mobility solutions, including electric scooters, motorcycles, kick-scooters, and e-bikes. Guangzhou-based XPeng manufactures smart EVs such as the G3 SUV and P7 sports sedan.

Retail interest has soared: message volume for NIU and XPEV has more than doubled on Stocktwits over the past month, with sentiment meters closing out on ‘bullish’ levels over the past few sessions.

Strong first-quarter earnings have only reinforced the optimism.

Niu

In the first quarter of 2025, Niu sold 203,000 units, marking a 57.4% year-over-year (YoY) jump. Sales in China rose 66%, and overseas sales grew 6.4%. Total revenue reached 682 million yuan ($94.6 million), a 35% increase from a year earlier.

The company also expanded aggressively, opening 384 new stores, with half in Tier 3 and Tier 4 Chinese cities.

However, Niu noted pressures in the form of an inventory glut in Europe and changing U.S. tariff policies.

With a market valuation of just over $251 million, the small-cap company expects to regain profitability in the second half of 2025 in the U.S. through price hikes and by taking advantage of the temporary 10% tariff window between America and China.

One bullish user on NIU’s stream said they would “buy more” of the stock, citing narrowing losses, increasing revenue and great future projections.

XPeng

XPeng’s Q1 revenue more than doubled to 15.81 billion yuan, and losses narrowed. The company expects Q2 deliveries between 102,000 to 108,000 units — a YoY growth range of 238% to 258%.

The company said it had made "significant improvements" in cost reduction, and vehicle gross margin increased for seven consecutive quarters.

Bernstein analysts cited strong performance from higher-priced models like the new G7, the upgraded P7, and a new full-electric vehicle. Still, they noted that XPeng’s success would depend on sustained demand for its premium offerings.

"Looks like lots of people are trading this as opposed to investing. I'm holding anyway, the 6 month chart looks very bullish," said one bullish user on XPEV's stream.

Market Outlook

According to a Dow Jones Newswires report, HSBC Global Research expects China’s EV demand to remain strong in May and June, driven by new models, refreshed supply, and price discounts.

Budget models like XPeng’s Mona 03 are gaining traction, but the firm warns that industry profits may remain under pressure due to pricing challenges.

The brokerage prefers EV makers with "strong new car cycles, such as Geely and XPeng.”

Wall Street Pulse

NIU stock trades at a 25% discount to the average price target of $4.53. Of the four analysts covering the stock, three rate it a 'Buy,' and one rates it a 'Hold.'

XPEV stock trades at a 23% discount to the average target of $25.26. Among 29 analysts, 21 give it a 'Buy' or 'Strong Buy,' seven say 'Hold,' and just one recommends 'Sell.'

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_da95861470.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)