Advertisement|Remove ads.

XPeng Stock Rises Pre-Market On Upbeat Q1 Earnings, Strong Q2 Forecast: Retail Turns Bullish

Shares of Chinese EV maker XPeng Inc. (XPEV) are trading nearly 7% higher in pre-market on Wednesday after its first-quarter earnings report beat Wall Street expectations.

The company reported Q1 revenue of RMB15.81 billion ($2.19 billion), a 141.5% increase year-over-year (YoY), and above an analyst estimate of RMB15.69 billion, as per Finchat data.

Adjusted and diluted loss per American depository share (ADS) was RMB0.45, compared with RMB1.49 for the first quarter of 2024, and below an estimated loss of RMB1.51 per share.

The increase in revenue was spurred by the increase in vehicles delivered by the company in the three months through the end of March. XPeng delivered 94,008 vehicles in the period, marking a year-on-year growth of 331%.

XPeng CEO Xiaopeng He said that quarterly deliveries hit a historical high despite seasonality for car sales.

“We remain committed to our steadfast long-term growth strategy and continue to launch more blockbuster products,” He said. “We are just beginning to unleash our growth potential.”

Gross margin stood at 15.6% for the first quarter, as compared to 12.9% from a year earlier.

The company ended the quarter with cash and cash equivalents, restricted cash, short-term investments, and time deposits of RMB45.28 billion, compared with RMB41.96 billion as of December 31, 2024.

For the second quarter, XPeng expects to deliver between 102,000 and 108,000 vehicles, representing a YoY increase of 257.5%.

The company sees Q2 revenue between RMB17.5 billion and RMB18.7 billion, representing a YoY increase of approximately 115.7% to 130.5%, and above an analyst estimate of RMB16.89 billion.

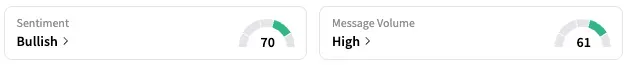

On Stocktwits, retail sentiment around XPeng rose from ‘neutral’ to ‘bullish’ territory over the past 24 hours while message volume rose from ‘normal’ to ‘high’ levels.

A Stocktwits user expressed optimism for the company reaching profitability in the next 12 months after the Q1 earnings report.

XPeng has not turned a profit since its founding in 2014.

XPEV stock, however, is up by over 70% this year and has more than doubled its value over the past 12 months.

Also See: Medtronic Announces Split Of Diabetes Business As Standalone Public Company: Retail’s Unmoved

For updates and corrections, email newsroom[at]stocktwits[dot]com.

(Exchange Rate: 1 RMB = 0.14 USD)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)