Advertisement|Remove ads.

Norwegian Cruise Stock Shot Up 10% Today – Find Out Why

Norwegian Cruise Line Holdings (NCLH) CEO Harry Sommer said on Thursday that consumer demand rebounded in May and has been strong even for European sailings heading into the third quarter.

“We saw from a choppy April to a record May through July. But I'd say the primary driver was the improvement in the macroeconomic environment,” Sommer said during a post-earnings call.

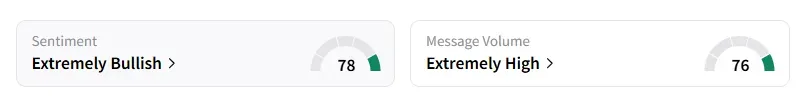

Retail sentiment on the stock improved to ‘extremely bullish’ from ‘bullish’ a day ago, with chatter at ‘extremely high’ levels, according to data from Stocktwits.

Shares of Norwegian Cruise jumped about 10% during midday trading. The retail user message count on Norwegian Cruise surged nearly 500% in the last 24 hours on Stocktwits.

A Stocktwits user noted that the stock was bound to hit an inflection point eventually.

Earlier this week, Norwegian Cruise, as part of its private island transformation on Great Stirrup Cay in the Bahamas, announced its plans for Great Tides, a massive six-acre water park opening in 2026.

“The Great Tides Waterpark, next summer is expected to be a positive demand driver, and with its summer launch, we expect to see a full benefit starting in 2026 and throughout 2027,” Sommer added.

Norwegian Cruise maintained its annual adjusted profit forecast of $2.05, a 16% rise year-over-year.

The stock has fallen 1.4% year-to-date and has gained over 46% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Carvana Stock Hits All-Time High After Price Target Revisions, But Retail Holds A Bearish Bias

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)