Advertisement|Remove ads.

Novavax Stock Slides As 2024 Revenue Cut Offsets Q3 Beat, Dampening Retail Confidence

Novavax, Inc. ($NVAX) shares fell more than 7% on Tuesday morning after the COVID-19 vaccine company reduced its 2024 revenue outlook yet again. The third-quarter results, however, came in ahead of expectations.

Gaithersburg, Maryland-based Novavax reported a third-quarter loss of $0.76 per share, narrower than the year-ago loss of $1.26 per share. The quarterly loss per share was also narrower than the consensus.

Revenue plunged 54.80% year-over-year (YoY) and about 89% sequentially to $84.51 million but topped the $65.8-million consensus estimate.

The YoY slump was due to the absence of $186.99 million in grants that benefited the year-ago quarter.

Third-quarter product sales, and licensing, royalties and other revenue climbed more than 17% and 133% YoY, respectively.

CEO John Jacobs said, "Novavax continues to focus on our corporate growth strategy of driving value from additional business development activities and organic R&D using our proven technology platform."

The executive also noted significant progress in defining its R&D strategy as the company looks to expand beyond COVID-19 and influenza.

During the quarter, the company made advanced preparations for Sanofi ($SNY) to assume lead commercial responsibility of Nuvaxovid COVID-19 vaccine for the 2025-26 flu season in the U.S.

Cash, cash equivalents, marketable securities and restricted cash at the end of the quarter was $924 million, up from $584 million at the end of 2023.

Novavax cut its 2024 revenue guidance from $700 million-$800 million to $650 million-$700 million. The downward adjustment reflected a reduction in the product sales guidance from $275 million-$375 million to $175 million-$225 million, partly offset by an increase in licensing, royalties and other revenue outlook from $425 million to $475 million.

On Monday, the company said the FDA has removed the clinical hold on its investigational new drug application for its COVID-19-influenza combo and standalone influenza vaccine candidates. This allows the company to enroll patients in the planned Phase 3 trial.

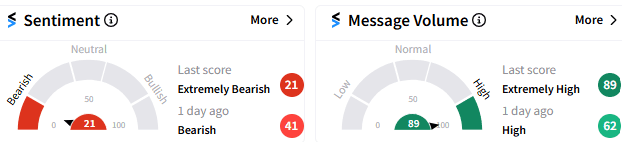

Retail sentiment toward the stock was muted. The sentiment meter on the Stocktwits platform showed an ‘extremely bearish’ outlook (21/100) toward the stock, although message volume spiked to “extremely high.”

A Stocktwits user said the company may not be able to capture a decent share of the COVID-19 vaccine market.

Another who is bullish on the stock, sees shots increasing, entering into the winter season.

As of 10:09 am ET, the stock was down 7.38% at $8.35.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218181377_jpg_f2dccc3db9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2245017747_jpg_f783731632.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_China_i_Phone_jpg_bcedab655a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)