Advertisement|Remove ads.

Novavax Stock Rallies On Upbeat Q1 Earnings, Revised Full-Year Revenue Forecast: Retail’s Elated

Shares of Novavax, Inc. (NVAX) traded 16% higher on Thursday morning after the company reported upbeat first-quarter (Q1) earnings and raised its full-year financial guidance.

Total revenue in the quarter was $667 million, compared to $94 million in the same period in 2024, and above an analyst estimate of $344 million, per Koyfin data.

The company said the increase in revenue was primarily due to $603 million in revenue recognized with the termination of two Advance Purchase Agreements (APA) and related to cash received in prior years.

Net income for the first quarter of 2025 was $519 million, compared to a net loss of $148 million in the same period in 2024.

Diluted earnings per share came in at $2.93, up from a loss per share of $1.05 in the corresponding quarter of 2024, and above an analyst estimate of $1.41.

The company also raised its full-year revenue guidance to between $975 million and $1.025 billion, up from its previous guidance of between $300 million and $350 million. This excludes Sanofi supply sales, Sanofi royalties, and Sanofi influenza-COVID-19 combination and Matrix-M-related milestone payments.

The firm also reiterated hopes for approval for its COVID-19 vaccine.

The protein-based vaccination was previously cleared for emergency use. The company is now looking at a normal, full approval, allowing for continued use, similar to Pfizer and Moderna's messenger RNA-based COVID-19 shots.

Novavax said last month that it had received formal communication from the FDA in the form of an information request for a “postmarketing commitment” to generate additional clinical data.

The firm said on Thursday that discussions with the FDA are ongoing and its vaccine application is approvable upon alignment on study parameters for the postmarketing commitment.

Postmarketing commitments refer to studies or clinical trials that a sponsor has agreed to conduct, but are not required by statute or regulation. They are conducted after approval to gather additional information about a product's safety, efficacy, or optimal use.

The approval will trigger a $175 million milestone payment from its partner and French drugmaker Sanofi.

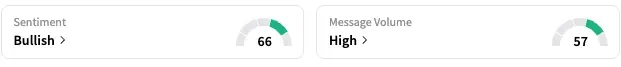

On Stocktwits, retail sentiment around Novavax jumped from ‘bearish’ to ‘bullish’ territory over the past 24 hours while message volume rose from ‘normal’ to ‘high’ levels.

NVAX stock is down 19% this year but up 54% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rolls_royce_jpg_07109534ba.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraft_heinz_jpg_4db2a61952.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)