Advertisement|Remove ads.

Why Did Dermata Therapeutics Stock Surge 22% Pre-Market Today?

- The offering, alongside two series of warrants that permit future purchases of the same amount of shares, is priced at $2.04 per unit.

- The company plans to use the proceeds for general corporate needs, including consumer research and rollout activities for its forthcoming over‑the‑counter acne kit.

- In early December, Dermata said it is preparing to launch a fresh brand identity for its over-the-counter skincare line.

Dermata Therapeutics, Inc. (DRMA) stock surged 22% in Wednesday’s premarket after the company announced that it has struck definitive agreements to issue roughly 2.02 million shares of its common stock in a private placement deal.

The offering, alongside two series of warrants that permit future purchases of the same amount of shares, is priced at $2.04 per unit.

Use Of Proceeds

Dermata expects roughly $4.1 million in gross proceeds initially, before fees and expenses. If all new warrants are exercised for cash, the number could rise by approximately $8.3 million, bringing total potential funding to nearly $12.4 million.

The company plans to use the proceeds for general corporate needs, including consumer research, rollout activities for its forthcoming over‑the‑counter acne kit, licensing initiatives, possible strategic investments, and working capital.

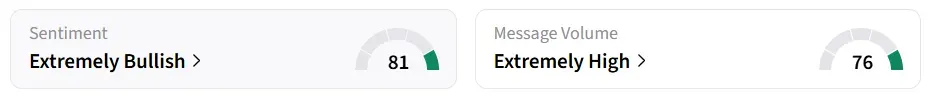

Following the announcement, Dermata Therapeutics’ stock traded over 24% higher in Wednesday’s premarket. On Stocktwits, retail sentiment around the stock jumped to ‘extremely bullish’ from ‘bearish’ territory the previous day. At the same time, message volume shifted to ‘extremely high’ from ‘extremely low’ levels in 24 hours.

Dermata creates science-based skin treatments with a focus on over-the-counter (OTC) skin products.

Dermata’s Skincare Line

In early December, the company said it is preparing to launch a fresh brand identity for its over-the-counter skincare line, signaling a move toward a science-driven, direct-to-consumer model.

Central to the rebrand is Dermata’s proprietary Spongilla technology, which is expected to enhance the efficacy of routine skincare. By simplifying regimens and boosting results, the products are designed to amplify the overall effectiveness of a skincare routine.

The latest funding strategy with a fresh financing move is aimed at extending the runway for the company’s upcoming consumer skin‑care initiatives.

DRMA stock has declined 84% year-to-date.

Also See: Intel’s Manufacturing Push Faces Fresh Test After Nvidia Passes On 18A Chips: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ethereum_blue_original_jpg_b6e7cc57f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_microstrategy_michael_saylor_resized_9fd19e69ec.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)