Advertisement|Remove ads.

Novo Nordisk Inks $2.2B Deal With Septerna: Retail’s Thrilled

Danish drug maker Novo Nordisk (NVO) on Tuesday announced an exclusive global collaboration and license agreement with U.S.-based Septerna, Inc. (SEPN) to discover, develop, and commercialise oral small-molecule medicines for obesity, type 2 diabetes, and other cardiometabolic diseases.

The company said the deal could be worth up to $2.2 billion. This includes more than $200 million in upfront and near-term milestone payments to Septerna and additional research, development, and commercial milestone payments.

The California-based company is also eligible to receive tiered royalties on global net sales of marketed products.

Novo Nordisk will cover all research and development expenses for partnered programs under the collaboration.

The agreement is expected to close in the second quarter of 2025.

The companies will initially commence four development programmes for potential small-molecule therapies directed at select G-protein-coupled receptor (GPCR) targets. GPCRs are a large and diverse family of cell membrane proteins involved in cellular communication.

Septerna CEO Jeffrey Finer said that the collaboration provides an opportunity to create multiple oral medicines and provides the company with the operational flexibility and resources to advance its portfolio of other GPCR-targeted programmes.

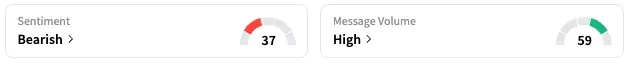

On Stocktwits, retail sentiment around Novo Nordisk fell from ‘bullish’ to ‘bearish’ territory over the past 24 hours while message volume dropped from ‘extremely high’ to ‘high’ levels.

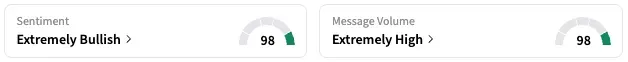

Meanwhile, retail sentiment on Septerna jumped from ‘bearish’ to ‘extremely bullish’ territory while message volume jumped from ‘normal’ to ‘extremely high’ levels.

A Stocktwits user expressed concerns about the new agreement, opining that Septerna’s pipeline is in the “early stage.”

However, another investor expressed optimism on the stock if it breaks the $12.40 mark.

SEPN stock is up by about 70% in premarket trading on Wednesday.

The stock is down by 68% this year and nearly 69% over the past 12 months.

NVO stock, meanwhile, is trading nearly 3% higher in pre-market.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)