Advertisement|Remove ads.

Novo Nordisk Stock Rises Pre-Market On Q1 Beat Despite Lowering Outlook – Retail’s Elated

Shares of Novo Nordisk (NVO) jumped 5% in pre-market trading on Tuesday after its first-quarter earnings beat estimates but revised its full-year outlook downward citing the impact of compounding pharmacies in the US.

The company reported net sales of DKK78.09 billion ($11.89 billion) for the first quarter (Q1), marking a growth of 19% from the corresponding period of 2024, and above an analyst estimate of DKK78.02 billion, as per Finchat data.

Net profit came in at DKK29.03 billion, marking a 14% year-on-year (YoY) increase, while diluted earnings per share jumped 15% to DKK6.53, above the expected DKK6.15.

The company’s sales in the U.S. increased 20% to DKK44.32 billion, while sales in international markets rose 18% in the quarter to DKK33.77 billion.

The company’s blockbuster weight loss drug Wegovy witnessed sales increase 85% to DKK17.36 billion in the quarter, while its diabetes drug Ozempic saw an 18% jump in sales to DKK32.72 billion.

The company’s overall sales within its obesity care segment grew 67% to DKK18.42 billion, while its diabetes segment sales grew 10% to DKK55.04 billion.

The company now expects sales growth of between 13% and 21% at a constant exchange rate in 2025, down from its previous outlook of between 16% and 24%.

Operating profit growth is expected to be 16% to 24% at a constant exchange rate, down from its older outlook of 19% to 27%.

Novo Nordisk said the updated sales outlook reflects the “lower-than-planned penetration” of its obesity and diabetes drugs in the U.S. owing to the “rapid expansion” of compounding pharmacies.

"It's unprecedented in our industry to have very large volumes of products flowing to patients that are not approved. We were really surprised about that," CEO Lars Fruergaard Jørgensen said.

He added that the company is now undertaking various measures to prevent unlawful compounding of its drugs in the country.

It is now illegal under U.S. compounding laws to make or sell compounded semaglutide, the active ingredient in Wegovy and Ozempic. The U.S. Food and Drug Administration has given outsourcing facilities compounding semaglutide till May 22 to stop, following which action could be taken.

“We now expect that compounding will be knocked off, so to say, and we get that business growth going forward,” Jørgensen told CNBC.

The new outlook also reflects expected periodic supply constraints and related drug shortage notifications for certain products and geographies but is based on assumptions that the global or regional macroeconomic and political environment will not significantly change Novo Nordisk's business conditions during 2025, including changes in tariffs and duties.

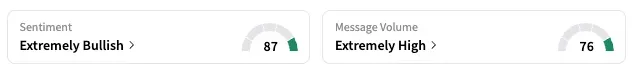

On Stocktwits, retail sentiment around Novo Nordisk jumped from ‘bullish’ to ‘extremely bullish’ territory over the past 24 hours while message volume rose from ‘high’ to ‘extremely high’ levels.

NVO stock is down by about 24% this year and by about 48% over the past 12 months.

Also See: Tesla Launches New, Cheaper Variant Of Model Y In US: Retail Stays Optimistic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

(Exchange Rate: 1 DKK= 0.15 USD)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tilray_Brands_jpg_add037e8e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wendy_s_resized_jpg_9b298d0aee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260984359_jpg_566af2429c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alphabet_jpg_b0657d669f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)