Advertisement|Remove ads.

Nu Holdings Stock In Focus Ahead of Q3 Earnings: Retail Sentiment Inches Up

Shares of Nu Holdings ($NU), which operates Nubank, were down nearly 1% on Wednesday afternoon (3:04 pm ET) ahead of its third-quarter earnings, with the retail sentiment staying neutral.

Wall Street estimates the Latin America-based fintech company will post Earnings Per Share (EPS) of $0.11 on revenues of $2.61 billion. In its second quarter, Nu Holdings doubled its net income year-on-year, and revenues jumped 65% to reach $2.8 billion.

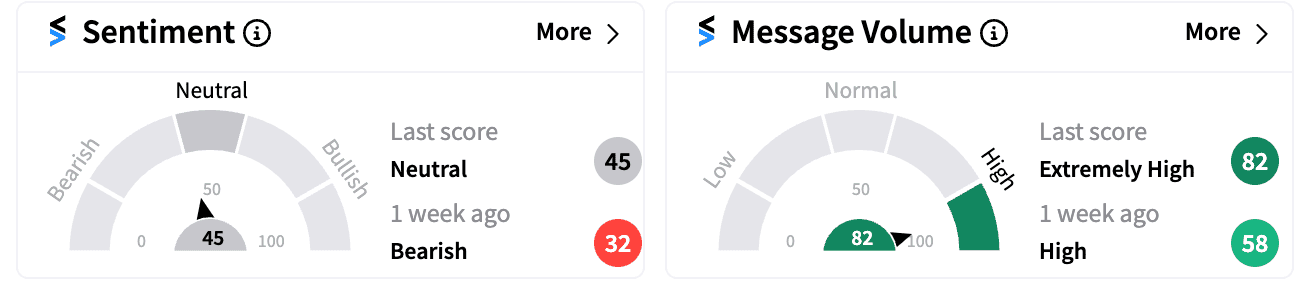

Retail sentiment on the stock turned ‘neutral’ (45/100) from ‘bearish’ (32/100) a week ago. While the message volumes have risen to the ‘extremely high’ zone.

With its rapid growth in Latin America, Nu Holdings, has attracted the attention of Warren Buffet. Berkshire Hathaway owned over 107 million shares of NU stock at the end of the second quarter. The firm reportedly invested $1 billion in its initial public offering (IPO) in 2021.

David Velez, founder and CEO of Nubank, said at the time of its last quarterly results, the company had ambitious growth plans and had set sights on becoming the largest consumer technology platform in Latin America.

“The recent launch of checking accounts in Mexico and Colombia has ushered deposits of US$3.3 billion and US$220 million in those countries, respectively, and fuels our growth expectations in those operations," Velez said in a statement.

Wall Street analysts will be watching out for the firm’s outlook in 2025 and management’s comments on the current financials of the company amid any macroeconomic views on the regions it serves.

NU stock is up 94% year-to-date.

For updates and corrections, email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_market_OG_2_jpg_d58f0a637e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ray_dalio_resized_jpg_d2f1d535bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)