Advertisement|Remove ads.

Nvidia CFO Pushes Back On AI Bubble Fears, Highlights Growth

- Colette Kress sees global data-center infrastructure, much of it GPU-powered, could reach as much as $3 trillion to $4 trillion by decade's end.

- Kress said workloads that once ran on CPUs are increasingly migrating to GPU-accelerated systems.

- She added that almost all of Nvidia’s new shipments are additive, expanding compute capacity.

Nvidia Corp. (NVDA) Executive Vice President and CFO Colette Kress reaffirmed the company’s long-term edge in AI hardware and infrastructure.

Speaking at the UBS Global Technology & AI Conference 2025 on Tuesday, Kress pushed back concerns ranging from an AI bubble to intensifying competition.

Nvidia’s Strategic View

According to Kress, what many see as a bubble is in fact a structural shift; workloads that once ran on CPUs are increasingly migrating to GPU-accelerated systems, driven by the demands of modern AI, cloud, and data-center workloads.

“Let's not forget the need to transition to accelerated computing. Most of all workloads, most of all work done in the data center has been done with CPUs for years.”

-Colette Kress, Executive Vice President and CFO, Nvidia

She forecast that by the end of the decade, global data-center infrastructure, much of it GPU-powered, could reach as much as $3 trillion to $4 trillion in scale, roughly doubling the existing base.

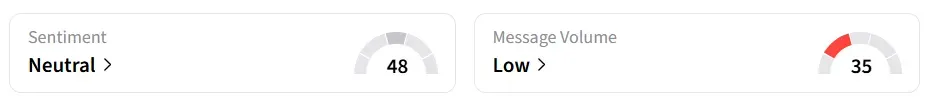

Nvidia’s stock inched higher by 0.6% on Tuesday mid-morning. On Stocktwits, retail sentiment around the stock shifted to ‘neutral’ from ‘bullish’ territory the previous day. Message volume changed to ‘low’ from ‘normal’ levels in 24 hours.

Competition And Nvidia’s AI Advantage

Speaking about emerging rivals or new architectures eroding Nvidia’s dominance, Kress stated that the company remains confident, pointing to its “Grace Blackwell” and soon-to-launch “Vera Rubin” systems.

She added that almost all of its new shipments are additive, expanding compute capacity rather than replacing older hardware. “It's true. It's true that most of the installed base still stays there,” Kress added.

Nvidia announced on Monday its plan for a $2 billion stake in Synopsys, the semiconductor design software provider. The investment could help bring Nvidia’s GPUs into more industrial and engineering applications.

NVDA stock has gained over 35% year-to-date.

Also See: Wedbush Elevates Unity To ‘Best Ideas’ List Along With A $55 Price Target

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)